The consumption of fashion items among Romanians remains high, with 9 out of 10 people purchasing at least one clothing item per month.

Main Figures from the MKOR Fashion Retail Study:

- Fashion Item Consumption: The consumption of fashion items among Romanians remains high, with 9 out of 10 people purchasing at least one fashion item (clothing, footwear, accessories) monthly.

- Fashion Market in Romania: Despite economic fluctuations, interest in fashion remains constant, with most consumers preferring clothing, followed by footwear and accessories.

- Online vs. Offline Shopping: Approximately 20% of Romanians prefer exclusive online shopping, while physical stores continue to be the primary source for over half of fashion purchases. Additionally, a quarter of consumers opt for a mix of online and offline channels, with 1 in 4 people preferring a combination of both.

- Ethical Consumption: 38% of Romanians, especially Generation Z and those with lower incomes, adopt ethical consumption behaviors, choosing second-hand products to support sustainability, according to the Ethical Consumer 2024 study.

Content

Download the free MKOR study „Romania Fashion Market” and discover the complete results

General Behaviors in Fashion Consumption

According to this MKOR study, it’s noted that 9 out of 10 Romanians purchase at least one fashion item monthly. This phenomenon may reflect our passion for style and trends, highlighting the increased importance we place on our personal appearance in contemporary society, or perhaps the fact that we’re not shy about spending our money.

Alongside the constant growth in fashion purchases, the study points out that 15% of buyers face product returns. This becomes a crucial aspect of the shopping experience in the Romanian fashion industry, where significant attention is needed for the return processes of clothing items.

Fashion returns can be influenced by various factors, ranging from size and color discrepancies to issues related to the quality of the products or unmet customer expectations. In this sense, transparency and the quality of information provided by brands and stores can help reduce the rate of returns, thus indirectly increasing customer satisfaction.

Thus, a clear and friendly returns policy strengthens consumer trust in brands and stores, offering reassurance that they are taken seriously.

The results of this study were extracted from Fashion Consumer Trends.Live, an MKOR quarterly tracker that represents the retail fashion market level. Some of the data provided here were extracted from the Romanian Consumer Sentiment – December 2023 and Consumer Study 2024.

MKOR has expertise in conducting research studies for the fashion industry, both for their own brand and for various clients in Romania. For example, at the end of 2019, Enzo Margi, a Romanian fashion designer, was preparing to enter the local market with his own brand. To lay a foundation for his launch strategy with up-to-date market data and to gain a detailed understanding of Romanian consumer behavior in the fashion domain, the company turned to us.

The collaboration began with the acquisition of the ready-made study “Digital Fashion Consumer Trends” conducted by MKOR Consulting. Later, in a supplementary phase, the client expressed interest in understanding the potential of the initial market, especially within the Premium and Luxury segments. Consequently, they decisively ordered a customized market study tailored to the specific needs of the Enzo Margi brand.

Returning to our current study, it’s noteworthy that there is a growing concern for reducing fashion consumption. Specifically, 45% of respondents claim they avoid excessive fashion consumption and buy fewer clothes, while 23% seek sustainable alternatives for the fashion items they purchase.

This result could be very promising for businesses operating in this area focused on sustainability, recycling, and reuse of goods with the aim of protecting the environment.

39% of buyers state that they recondition and repair items, mainly men, and 33% purchase second-hand products, more so among women.

Download the free MKOR study „Romania Fashion Market” and discover the complete results

Omnichannel Fashion: Online and Offline

According to recent data, 2 out of 10 Romanians prefer to shop online when it comes to fashion. In the months of July to September, interest in online fashion shopping slightly decreases compared to other times of the year, as there is a shift towards physical store purchases. A possible explanation is that people travel during these months and may want to quickly secure their purchases, ensuring they can try them on and not need to return them. Additionally, during the months of August and September, many people purchase various clothing items for the start of the school year.

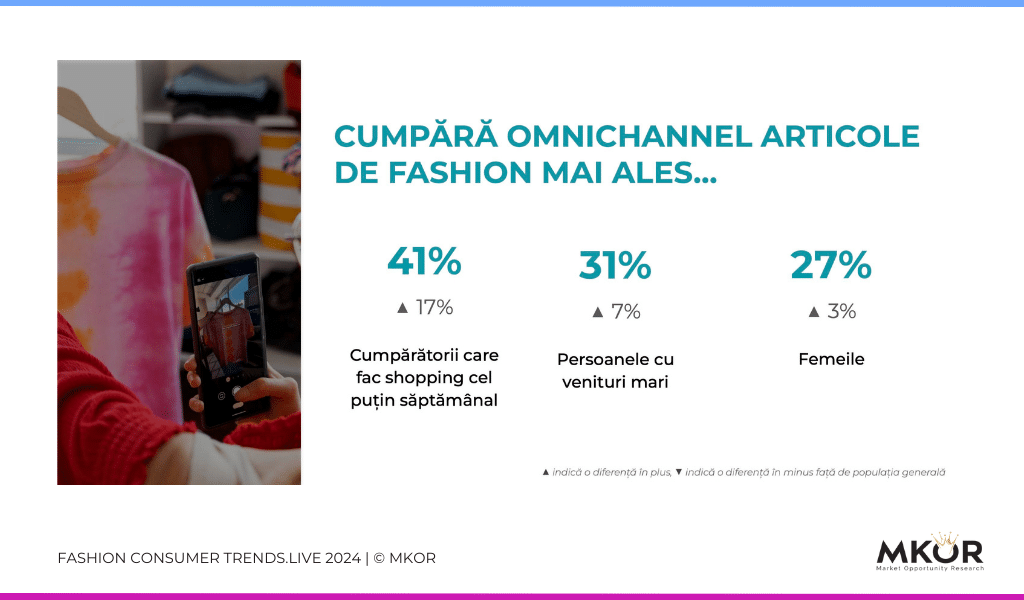

Up by 2% from 2021, 24% of consumers now prefer a mix of online and physical store options. These are typically individuals who make purchases at least weekly and have substantial incomes.

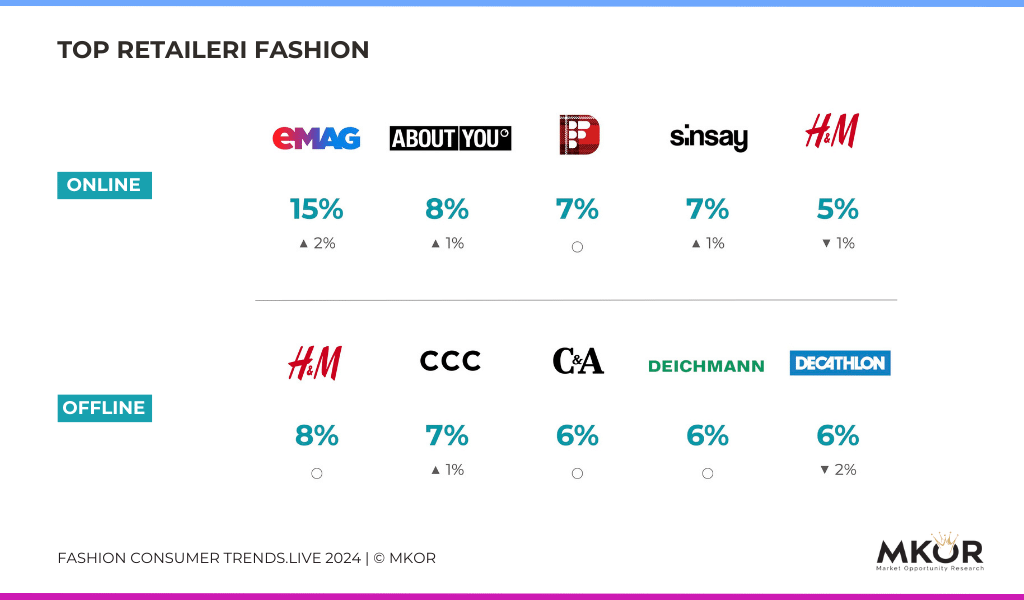

By 2024, it is notable that eMag is the most preferred retailer for online purchases, followed by About You, Fashion Days, Sinsay, and H&M. Meanwhile, in the realm of physical stores, Romanian favorites include H&M, CCC, C&A, Deichmann, and Decathlon.

Dante International (eMAG, Fashion Days) dominates the online fashion retail market. Additionally, online stores based outside the country have gained more traction in the past year.

New international players entering the Romanian market are also seeing growth, such as Zalando. Second-hand fashion represents a niche option for Romanians, especially Gen Z and those with lower incomes — 4% of consumers have visited a second-hand store for fashion items last time.

However, only 1% of consumers have purchased second-hand fashion items online, from direct sales websites like OLX, with a slight increase among middle-income earners and parents of young children (+1%).

In the last year, consumers were five times more likely to shop at online stores based outside Romania for fashion purchases compared to previous years.

Romanians shop for clothing an average of 7.3 times per year, with a significant portion, 70%, saying that their most recent shopping session was for clothing. The MKOR study also showed that Romanians make purchases 3.7 times per year on average for shoes, with 41% of respondents saying they most recently added shoes to their cart.

The average amount spent per shopping session is 381 RON (an increase from 2022) across 1.4 categories of products. Clothing is the most purchased category, where Romanians spend the most, with 322 RON spent on the latest fashion acquisition, marking a 6% increase from 2022. Additionally, seven out of ten Romanians consider that their personal spending on fashion items has increased compared to the previous year, according to the Romanian Consumer Sentiment study.

Download the free MKOR study „Romania Fashion Market” and discover the complete results

Digital Experiences in Fashion Shopping

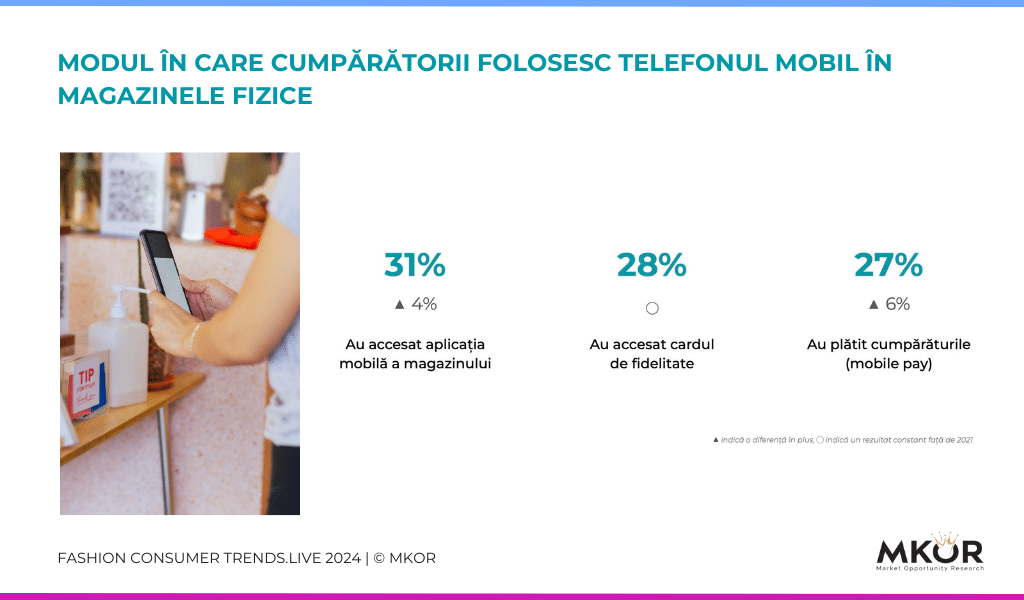

With the rapid evolution of technology, consumer behavior is significantly adapting. One of the most prominent trends is the increase in mobile phone usage during shopping sessions in physical stores.

According to recent data, 63% of consumers use their mobile phones in this context, showing a 10% increase from 2021. This trend reflects not only the adaptation to new technologies but also changes in the way people interact with physical shopping environments.

The MKOR study indicates that Generation Z and Millennials are the most frequent users of this payment method.

Additionally, one in two Romanians believes that digital experiences offered by retailers during the purchasing process influence the decision to return to the store. This highlights the importance of a well-developed digital presence and offering personalized and innovative services to build and maintain customer loyalty in an increasingly competitive environment.

Want to know more about the fashion market in Romania in 2024? Access the MKOR report now where you can compare data from 2023 versus 2022 and 2023 versus 2021.

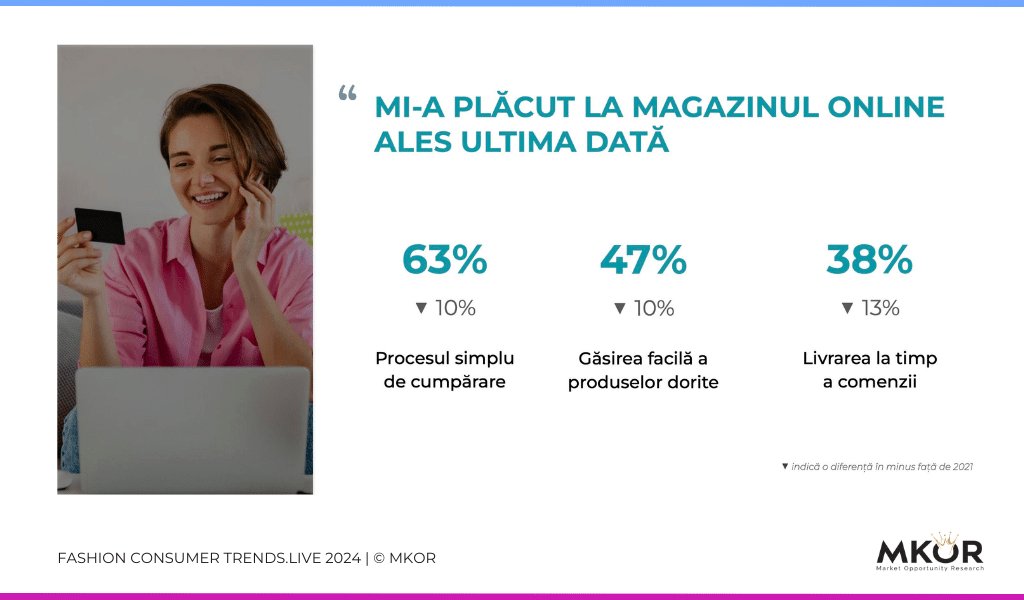

In 2024, as per the study, the online shopping experience becomes increasingly crucial for consumers. Despite this importance, not all aspects of the online shopping process are viewed favorably by customers. According to the data, 63% of respondents particularly appreciated the simplicity of the shopping process, a significant increase from 10% in 2021. This emphasizes the importance of an intuitive interface and a smooth shopping flow to maintain customer satisfaction.

Additionally, nearly half of the consumers (47%) reported that they were able to find their desired products easily, highlighting the importance of efficient search functionalities and clear product categorization on e-commerce platforms.

Prompt and timely delivery was also a key factor for 38% of consumers, underscoring the importance of having robust logistics and a reliable supply chain management to ensure a hassle-free and satisfying purchasing experience.

Among the favored features, consumers noted difficulties in finding desired products, the absence of reviews for some products (which complicates purchase decisions), and the lack of a detailed guide for sizes and measurements for each product.

Thus, understanding consumer needs and preferences is crucial for the success of retailers in today’s competitive market. Custom studies can empower your company with real market data. Contact us to set up a meeting to discuss the business needs of your company.

Despite the increasing popularity of online shopping, the offline shopping experience remains a significant aspect for many consumers. According to MKOR data, 46% of respondents stated that they appreciated the physical store environment the most, even though this figure shows a slight decrease from the previous year. This underscores the importance of creating pleasant and comfortable spaces in stores to attract and retain customers.

Additionally, approximately 42% of consumers mentioned that they found it easier to find quality products in physical stores. This highlights the need for retailers to offer a wide selection of high-quality products to meet and exceed customer expectations. Moreover, 41% of respondents appreciated the variety in physical stores. Therefore, creating a consistently pleasant and positive shopping experience can help build strong relationships with customers and encourage long-term loyalty.

However, there are still some less favorable aspects identified by respondents in our study, such as:

- Prices are not comparable with product quality (25%)

- Long wait times at checkout (18%)

- Products are not intuitively organized (15%)

The shopping experience, whether online or offline, continues to evolve in the technological context. Companies must be aware of consumer preferences and needs to remain competitive and gain customer loyalty.

It is important for retailers to invest in creating pleasant and intuitive experiences, regardless of the sales channel used. By understanding and adapting to these preferences, they can build lasting relationships with customers and ensure the long-term success of their business.

Information about the Fashion Consumer Trends.Live Study

- Sample size:

Number of respondents in 2021: 5,676

Number of respondents in 2022: 7,014

Number of respondents in 2023: 5,655 - Characteristics of the sample: Nationally representative based on gender, age, and geographic distribution. The general population of Romania aged between 18 and 65 years.

- Approach: Online, through the MKOR Panel

- Data visualization: Interactive dashboard, online

Access the full study to see all the findings 👇

Download the free MKOR study „Romania Fashion Market” and discover the complete results

Have you read everything? Comment / join our newsletter / read our other research posts!

Fashion ROute 2022: data extracted from the first real-time Romanian fashion retail study

August 12, 2022

0 Comments10 Minutes

57% of Romanian customers purchased fashion offline in September 2021

July 8, 2022

0 Comments6 Minutes