On October 27th and 28th, we participated as a research partner at retailArena 2021 – A Game of The Future, where we presented for the first time .Live data from the first real-time market study in Romania – Consumer Trends.Live.

We wanted to explore, together with our discussion partners, the main retail trends in 2021, so that each of the players in this sector can base their business strategy on relevant data, directly from the source.

- On the first day of the event, we defined the ethical consumer in terms of demographics and behaviour.

- On the second day of the event, we discussed the evolution of consumption in the pandemic year. We presented .Live data on market shares, budgets spent, procurement frequency, and share of procurement channels for six industries monitored within the Consumer Trends.Live platform.

Below are the main results discussed at retailArena 2021.

Who is the ethical consumer?

.Live data confirms new consumption trends in the 2021 pandemic year, which are very likely to continue in the post-COVID-19 era. And one such example is ethical consumption.

Consumer Trends.Live results show that such a consumer:

- comes from the urban environment

- has a higher education

- earns an average income

The tendency to migrate to ethical consumption grows with ageing.

What is the behavioural profile of the ethical consumer?

Usually, the ethical consumer is also pragmatic. He plans his purchases and tries to follow his plan when shopping, as he equals efficiency with a good shopping session.

The ethical consumer is also ECO. .Live data confirms that he knowingly chooses the products that are least harmful to the environment, while completely avoiding those that are. In addition, he prefers products in recyclable containers.

How does the ethical consumer purchase?

The ethical consumer takes his information from online but purchases omnichannel (both online and offline).

He prefers to buy from companies he knows are socially responsible.

Because he is well-informed before purchasing, he is less likely to return when purchasing online. In addition, the ethical consumer is satisfied with the shops he buys from and is more likely to recommend them to others (to become a promoter).

These are the brands the ethical consumer prefers:

- eMAG and H&M for online shopping

- Decathlon for offline shopping

What is the ethical consumer looking for?

When shopping, the ethical consumer is looking for:

- Quality of purchased products

- A fair value for money

- Detailed information about the products he wants to buy

He is willing to pay more for quality, but also for the products of socially responsible companies (9% more).

These differences vary by industry, from 8.5% for fashion items to 17.9% for jewellery.

Learn more about real-time ethical consumer behaviour directly from the market intelligence platform of the future – Consumer Trends.Live.

The evolution of consumption in online, offline and omnichannel environments, in a pandemic year

According to data analysed monthly in Q2 & Q3 in 2021 in six markets available on the Consumer Trends.Live platform:

- Romanians prefer to buy offline Fashion, Care & Beauty, Jewelry & Watches, and Home & Deco items (65% – 78%).

- Regarding the IT&C and Appliances markets, Romanians buy almost in equal proportions online and offline.

Key aspects of the online environment:

- Online consumers tend to buy more often than offline consumers in all markets analysed, except IT&C.

- Consumers tend to spend more per purchase when shopping online in all markets except Fashion and Jewelry.

eMAG is the Romanian preferred retailer, being the leader in the Appliances (online), IT&C (online and offline), Jewelry (online), Care & Beauty (online), and Fashion (online) markets.

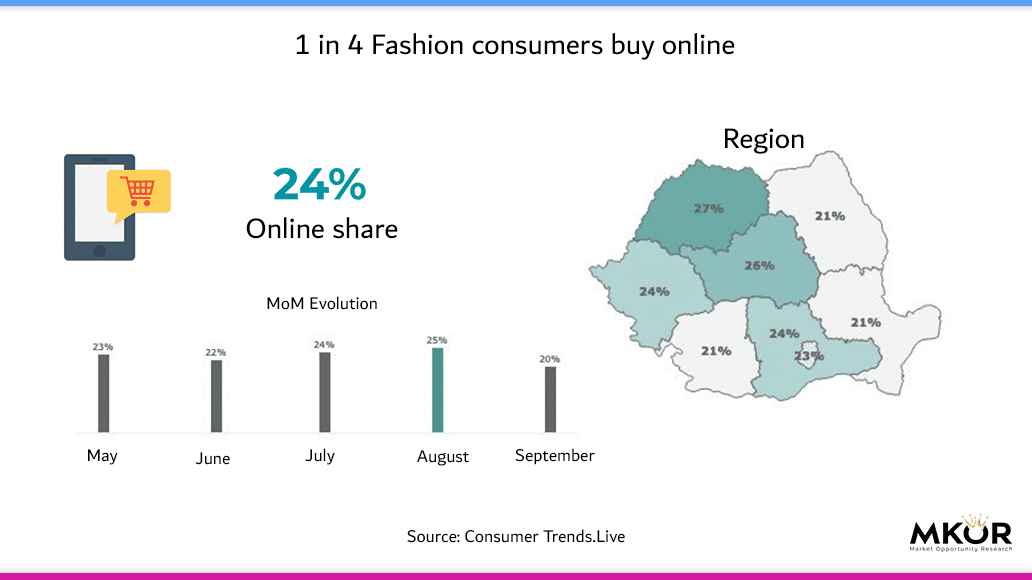

1 in 4 Fashion consumers purchases online, but pays less than in the physical store

Although the preference for online shopping increased by 3.7% compared to offline between May and September 2021, it varies by region.

On average, 1 in 4 Romanians (24%) prefer online fashion shopping.

They spent on average 288 RON per shopping session, 5.9% less than the average offline cart.

Top Fashion Brands:

- Offline – Decathlon, Deichmann, H&M

- Online – eMAG, About You, Fashion Days

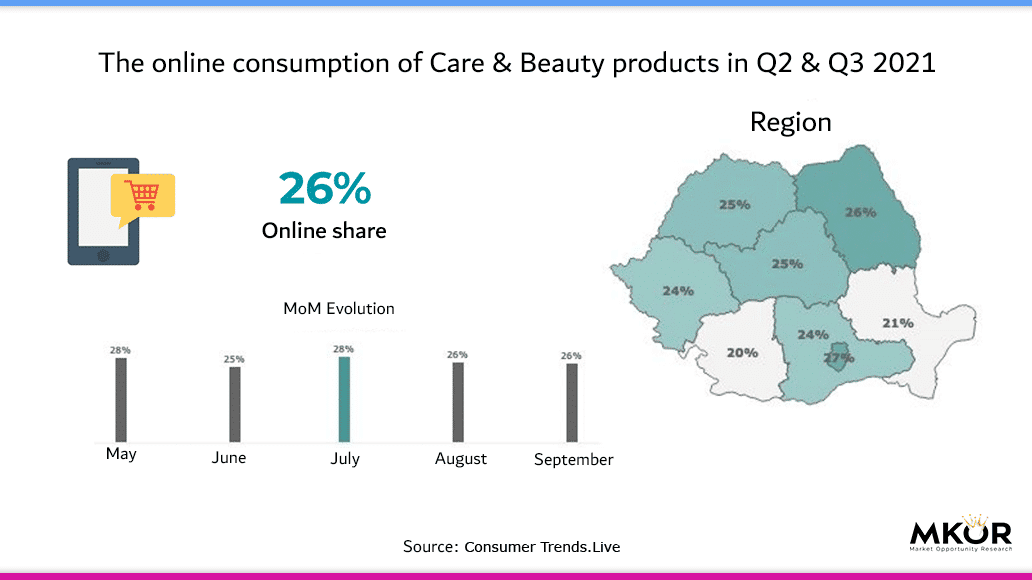

Online consumption of Care & Beauty products increased by more than a third in Q2 and Q3 2021

On average, 26% of Romanians bought Care & Beauty products online in Q2 and Q3 2021. Those in the Bucharest – Ilfov (27%) and North-East (26%) region buy online the most.

The preference for online purchases of Care & Beauty increased by 34% from May to September 2021.

Romanians bought Care & Beauty products 2.4 times on average per month during this period and with an average basket value of 217 RON.

Top Care & Beauty Brands:

- Offline – Kaufland, DM, Carrefour

- Online – eMAG, Avon, Notino

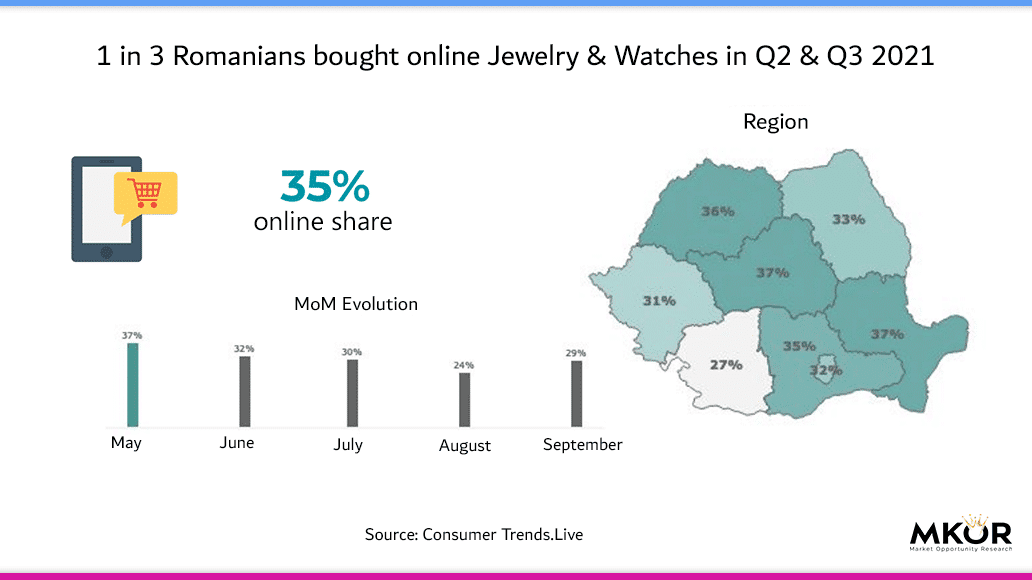

1 in 3 Romanians bought online Jewelry & Watches in Q2 & Q3 from 2021

35% of Romanians prefer to purchase Jewelry & Watches online, 14.3% more than those who purchase this category of products offline.

They bought such products online 1.6 times a month between May and September 2021, spending an average of 352 RON.

But the preference for online shopping in the Romanian Jewelry & Watches Market decreased by 1.9% compared to offline purchases, in the same time period.

Top Jewelry & Watches Brands:

- Offline – B&B, Pandora, Altex

- Online – eMAG, Elefant, B&B

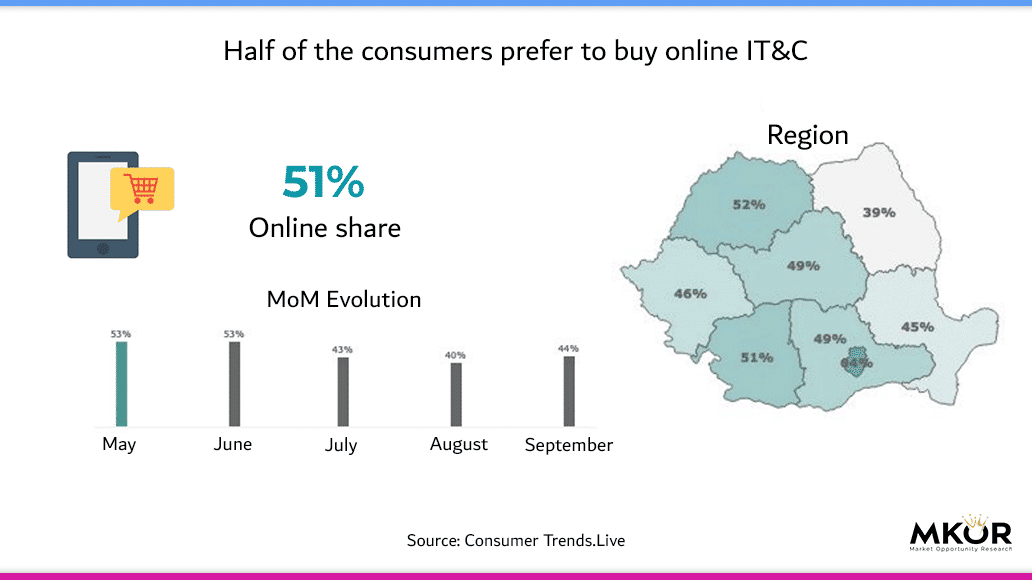

IT&C consumers purchase mostly online

The online environment has the largest share in the IT&C Market. Romanians bought online products in this category in a proportion of 51% between May and September 2021.

In Q2 and Q3 in 2021, online shopping increased by 6.7%. The purchasing frequency is lower than in the case of other industries (on average, 1.6 purchases per month), but the average budget spent is the highest (RON 1,485).

Top IT&C brands:

- Offline – Altex, eMAG, Media Galaxy

- Online – eMAG, Altex, Orange

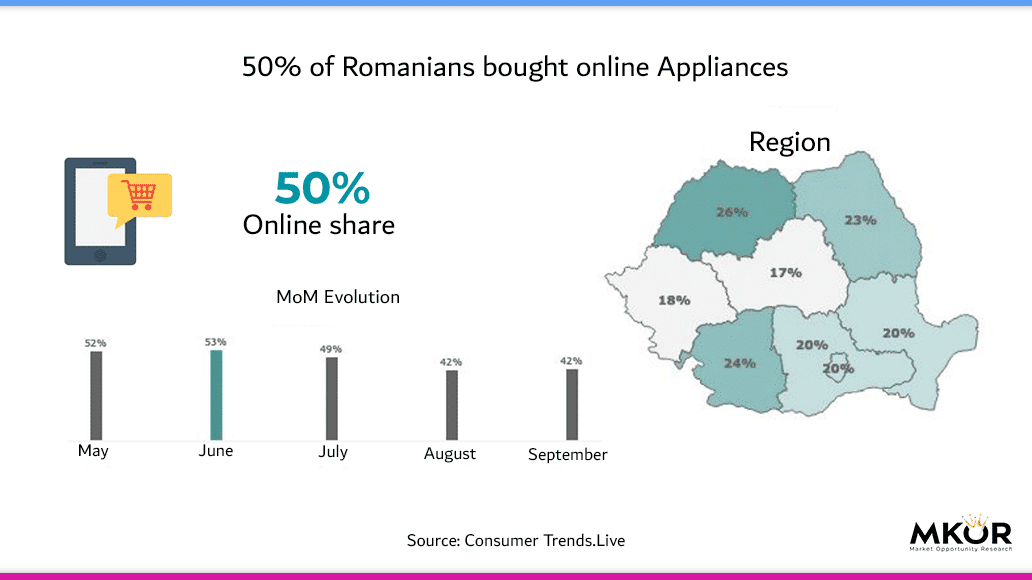

Appliances are on an upward trend in online shopping

1 out of 2 Romanians purchase Appliances online. Between May and September 2021, the share of online purchases in the Romanian Appliances Market increased by 5.6% compared to brick and mortar ones.

The average value of the basket was RON 1,306, up from the average value of the offline basket. The purchase frequency for such products is kept below 2 / month (1.9 times).

Top Appliances Brands:

- Offline – Altex, Media Galaxy, Carrefour

- Online – eMAG, Altex, Flanco

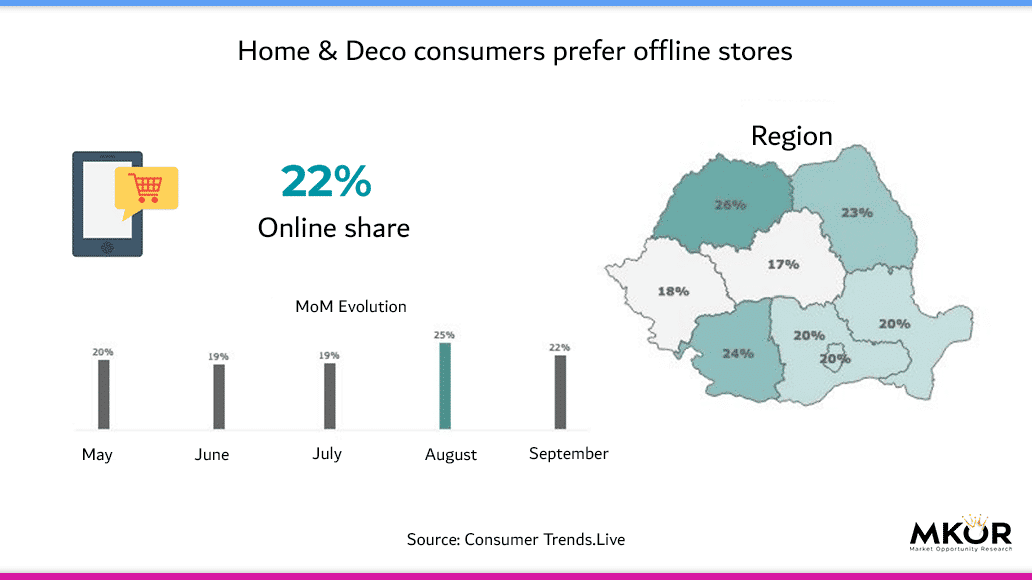

Home & Deco consumers prefer physical stores, but they pay more when they shop online

Only 22% of Romanians bought Home & Deco items online in Q2 and Q3 in 2021. They made an average of 1.9 online purchases between May and September, 5% less than offline.

The average shopping cart was 1,220 RON, 4.6% more than the average offline shopping cart.

Top Home & Deco Brands:

- Offline – Dedeman, Jysk, Leroy Merlin

- Online – Dedeman, Jysk, Ikea

Explore real-time consumption behaviours

Consumer Trends.Live, the first live market study in Romania, is a valuable tool for identifying retail consumer behaviours as they emerge.

By digitalising market research, we support retailers through monthly updated live data, directly from consumers.

Thus, for the first time, retailers can use up-to-date market information as the foundation for their business strategy, while they remain relevant to the target audience, and one step ahead of the competition.

For relevant market information, we encourage you to stay up to date with the latest news in our newsletter.

Have you read everything? Comment / join our newsletter / read our other research posts!

Retail Trends 2021: RetailArena 2021 Summary – A Game Of The Future

August 12, 2022

0 Comments10 Minutes