In the first part of this guide we talked about the importance of market research and the first steps you can take to start researching.

The second part of the guide focuses on Competitive Analysis, essential to any market study. To keep up to date with the other parties, we recommend subscribing to the newsletter.

Contents part 1

- What is a Market Study?

- Why would you do market research?

- When to do Market Research?

- What is the first step? General Market Analysis

- Sectoral Study

- The potential of the Market

- Trends and Tendencies

- Competitor Analysis, Porter’s 5 Forces

- The importance of market contextualization

- Resources used in documentation

- Who can do market research?

- Study models

- Do you need the expertise of specialists?

Conținut

Next Step: Competitive Analysis

Market research aims to analyze products and services on the market. Once the general market analysis has been done, the next natural step is a more thorough analysis of the market, including the competition.

In whatever sector you operate, even if your sales strategy is unique, there will always be other businesses competing to attract your customers.

A competitor is a rival company operating in the same industryas you, selling similar products and services. Competition can occur on the basis of price, the type of product or service offered for sale, the promotions launched or the quality of the services you offer.

Competitor analysis is an important part of the marketing plan, which aims to improve business decisions in order to always be aware of what is happening in the market.

Competitive analysis always positions you one step ahead

Competitive analysis can help you understand market dynamics and conditions. This means identifying risks and opportunities early so that the company’s strategy can be adapted. The ability to adapt to the market can be acquired from information obtained from competitors.

Whether you do it internally or with the help of a consulting firm, competitive analysis is a stage that any organization must go through, periodically.

Even if you are launching a completely new product or service, you must keep in mind that there is no such thing as an organization without competition. Even though you may not have direct competitors, consider indirect competition to be at least as important.

At the organization level, competitive analysis will mean different things to different people. For example, for a sales representative, it can represent concrete advice on how to offer to their customers, as effectively as possible. For management, it can mean information about the marketing strategies used by competitors to gain market share.

The ultimate goal of any competitive study is to provide information for better business decisionsand to increase organizational performance.

How is competition analysis done?

Approach this type of analysis from two perspectives: from the customer’s point of view and from their competitors’ point of view.

From the customer’s perspective

Look at your competitors’ product or services from the customer’s perspective. Why would the customer choose their services? Does the quality of their products make him buy it? From the customer’s point of view, you can better understandwhy you would choose other products instead of the ones offered by your company.

From the competitor’s perspective

The other perspective, from the competitors’ point of view, will help you to understand them better, to detect their strengthsand weaknesses. In other words, you will do the SWOT analysis from the perspective of your competitors.

Questions to ask

In order to carry out a competitive analysis as comprehensive as possible, you can ask a series of questions. The following questions are a good starting point:

- Who are the company’s competitors?

- What are the competitors doing?

- What profit do they get?

- What are the market practices?

- How do you position yourself against the competition?

- How aggressive is their promotional strategy?

- Do your competitors’ strengths or weaknesses coincide with your company’s?

- How can their strategies impact your business?

- How threatening are they to your company’s development?

Steps to follow

These questions will help you get a direction for your analysis. In the next step, delineate as much as possible a matrix to guide you. In this regard, here are some steps you can follow:

- Define the industry– what is the nature of the industry and what are the services and goods produced in the target market;

- Identify competitors– in an industry there are usually several competitors. It is important to identify those who are on the same level as you;

- Identify consumers– find out who your consumers are and what their expectations are;

- Determine Key Success Factors– find those factors that increase your prospects for success. It doesn’t matter if the factors are also found in the competition.

- Rate your competition– rate your competitors based on the key factors identified in the previous step.

This whole process will help you to see which of the competitors has a bigger input in the industry and how you could build an effective marketing strategy.

How many competitors should an analysis include?

There are markets where you can easily name all the competitors. These are concentrated markets where every competitor needs to be analyzed. Such examples are the automotivemarket or the steel processing market.

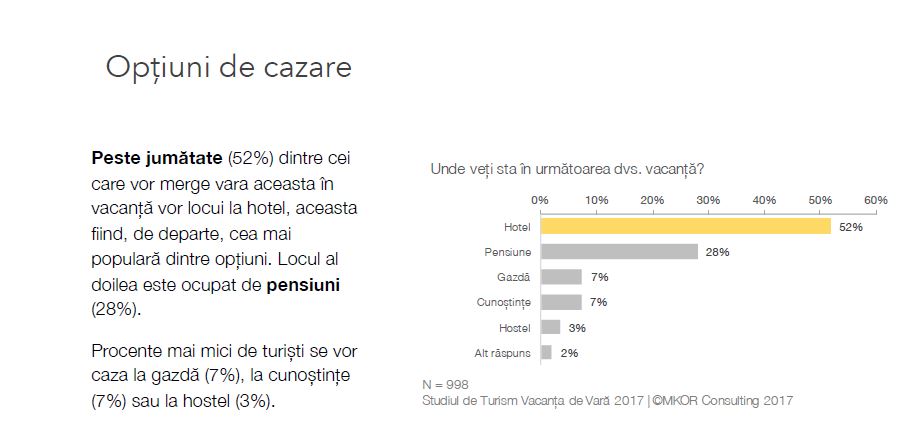

There are industries where competitors are not so obvious. This is the case in industries where the product or service can be easily replaced by another. For example, on the tourism market, there are many accommodation options: hotel, boarding house, hostel, accommodation, caravan, tent or Airbnb-type services.

Our study in the tourism market helps those active in this industry to understand what are the preferences of Romanians and what are the trends they are heading towards when it comes to spending holidays.

If you are active in a market with many competitors, the analysis becomes a little more complicated, but not insurmountable. Obviously, it is not efficient to gather information about all competitors, especially when there are a large number of them, and therefore you should focus your attention on a segment of the competition.

Regula 80/20

In fragmented markets with many competitors, there is a very high probability that 80% of the market is served by 20% of the competition. Therefore, you will carefully analyze this 20% of the market.

For example, in the market of computers and PCs there are, in addition to the big manufacturers – such as IBM and Apple, manufacturers of counterfeit products or cloned products. Applying the 80/20 rule, we will consider for analysis only the large manufacturers that hold 20% of the market.

However, the rule is not rigid and it is recommended to keep an opening as one of the players might come up with new technologies or an aggressive advertising campaign.

How do you get competitive intelligence?

Competitive analysis, unlike industrial espionage, is a legal and ethical form of gathering market intelligence. Secondary sources are a good starting point for competitive analysis. Secondary sources contain information that has a specific purpose and can be accessed by the general public.

You can look at what and how your competition is communicating. What they convey to the general public shows their ability to serve the market. Once you understand the approaches of your competitors you will know how to differentiate yourself and how to improve your products and services.

Some ideas on how you can monitor your competition internally include following their social media accounts, signing up for their mailing lists, or monitoring their press and online appearances through specialized tools.

Advertising

An opponent’s advertisement can provide information on prices charged, promotionsand allocated budgets. When analyzing an ad created by competitors, it’s good to look at where it appeared, how often it appears, what special offers and benefits are highlighted.

For example, if their ad appears in a publication that neither of you has appeared in before, this may mean that the other player is trying to target a new market segment.

Presentation brochures

Product presentation or sales leaflets and brochures provide information about howyour competitor prioritizes their productsand what features they choose to promote to consumers.

Articles in the press

Articles published in newspapers and magazines are a good source of information about your competitors’ future plans, how the company is organized and what new products they will launch in the market. Press investigations provide insider information on competing companies that you can capitalize on.

Websites

Useful information can be extracted from the websites of competing companies. The sections that deserve more attention are company history, team, pricing and portfolio. Each of these sections provides insightsthat can help you position yourself in the market.

For example, the company history section shows seniority and industry experience; the team description indicates how qualified the employees are; the pricing section provides clues as to the policy in place; the portfolio presents the customers who have placed their trust in the company.

With the help of website analysis you will be able to understand what kind of demand and supply exists in the market at a given moment and what are the standards practiced in a certain segment.

Market research using Google tools

Micro-moments

Competitive analysis is at your fingertips. With a simple Google search you can find out information that directly concerns your competitors, but also information about the size of the marketand about the existing supplyand demand .

The best sales strategy is to meet your customers’ needs exactly when and where they are looking for you. And as micro-moments are those moments, more and more common, when potential customers look for means to satisfy their needs on the Internet, it is important to be at the right place and time.

Jobs-to-be-done

The internet runs on content made up of links, words and images. People search the Internet using keywords that they find relevant.

For example, an entrepreneur who sells drills will be tempted to think that the people who will visit his store are those who have searched for the word drillon the Internet . He will probably be surprised to find that among his customers are those who have searched for how to punch a hole in the wall.

This happens because the products are not addressed to people, but to the problems they have to solve. In marketing, this approach is known as jobs-to-be-done. Knowing the keywords that consumers use in their searches is evidence of adapting to market demand.

Keyword Research

The results of a simple Google search tell you how competitive that market segment is, tell you what your customers are interested in, what services and products you can innovate. You can learn what approaches you can use to be successful in communication and how customers want to interact with your brand.

Using tools like Google’s Keyword Planner you can determine advertising opportunitiesor generate ideas for your marketing strategy.

Risk Analysis

Evaluation of competitors’ risk factors

Your competitors are exposed to risks like any other market player. The analysis of the competition also takes into account the calculation of the risk to which they are exposed. This helps you understand your competitors’ vulnerabilities: which players are in danger of exiting the market soon, and how you can avoid such situations by learning from the mistakes of others.

Risk factors relate to the financial situation, litigation and open files that companies face. These aspects can affect the image and credibility of the company, giving you a competitive advantage.

The main role of risk analysis is forecasting. By knowing your competitors’ risks, you will know how to negotiate more effectively and have a better understanding of market dynamics. In this way, you will be able to build a strategy that will contribute to the long-term development of the company.

Risk analysis is a good way to identify potential partners. By checking their financial situation and debt situation, you ensure that you will have a reliable partner by your side.

How can you determine the risks that competitors are exposed to?

Most of the time, financial information regarding the activity of companies is public, but it needs to be aggregated and interpreted to gain value. The main source of information in this regard is the National Office of the Trade Register, which provides information on the evolution of the company from registration to date.

There are a lot of tools that give you the ability to customize and get reports. For example, two such tools are Risco or CreditInfo. These platforms extract data from the website of the Ministry of Public Finance, which is a primary source of information.

SWOT analysis

SWOT is an acronym that comes from the English terms Strengths ,Weaknesses thatare internal to the company, Opportunities andThreats thatare external to the company. The SWOT analysis is a synthesized conclusion of the competitor analysis that includes and categorizes the answers to the questions asked previously.

Businesses that have been in business for some time can always use SWOT analysis to assess a constantly changing environment so they know how to proactively respond. The strategy review, which we recommend annually, should contain a SWOT analysis.

Start-ups or early-stage businesses can use analytics in their planning process. Keep in mind that there is no one-size-fits-all recipe for SWOT analysis and that every company has different needs. We tell you this from our vast experience in launching businesses.

Strengths (positive internal factors)

When looking for strengths consider the tangible or intangible characteristics that are internal to your company. These are attributes you can control. Guide yourself by the following questions:

- How are you? Fine?

- What internal resources do you have available? Think about: positive characteristics of the employees such as their training and skills or the company’s advantages such as the capital, the technology used and the clientele formed.

- What advantages do you have over the competition?

- Do you have increased development or production capacity?

Weaknesses (negative internal factors)

Weaknesses are those aspects that reduce the value you offer in the market and place you at a competitive disadvantage. It is necessary to correct these aspectsin order to compete.

- What should be improved to achieve your goals and compete with your strongest competitor?

- Does your business have limited resources?

- What is your business missing to thrive? (expertise, technology, trained people)

- What factors that are controllable are holding you back?

Opportunities (positive external factors)

Opportunities are the external factors that present reasons for your business to thrive. Their identification is the first step, followed by their exploitation. Some of the questions you can ask to identify them:

- What opportunities are there in the market that you can take advantage of?

- How is your business perceived in the market?

- Has the market grown recently or have changes occurred that create new opportunities?

- What is the frequency of market opportunities?

Threats (negative external factors)

Threats are external factors that you cannot control and that represent a risk to your strategy or even to your business. Even if you can’t prevent or control them, it’s good to identify the threats so you know how to address themshould they arise.

- What challenges can you identify in the market that pose risks to your business?

- Have raw materials become more expensive or do suppliers no longer have them?

- Have new regulations appeared that directly affect your company’s business?

- What technologies have a direct impact on the industry in which you operate?

Formulate recommendations

For each of the categories of factors in the analysis, it is recommended to be accompanied by a strategy and a series of recommendations that will serve as your guide. Follow the table below that will help you in formulating recommendations:

|

Opportunities (externe, pozitive) |

Threats (externe, negative) | |

| Strengths (interne, pozitive) | Recommendation: maximize strengths . How can you use your strengths to mitigate the identified threats? | Recommendation: Avoid or mitigate threats. How can you use your strengths to avoid the identified threats? |

| Weaknesses (interne, negative) | Recommendation: reduce weak points . What steps can you take to mitigate the weaknesses by taking advantage of the identified opportunities? |

Recommendation: change what you can control . How can you modify internal weaknesses to minimize the impact of external threats? |

Study models

Would you like to see practical examples of our guide? We have enough models with the market studies we have worked on. These are available for free download on the own studies page .

Choose your favorite subject and you’ll be able to access a professional study template in minutes using your email address and personal details. If you have an analytical nature, you will be able to study the answers to understand what type of questionnaire was applied within them.

Do you need the expertise of specialists?

MKOR Consulting offers market research services, customer satisfaction studies, target audience segmentation and customer profiling, competitor research, opportunity studies for new markets. All types of research that a business must perform in order to evolve.

Consult the portfolio of own studies and see what clients say about the results of MKOR specialists. And if you have any questions, don’t hesitate to contact us by phone or email!

Part 3 of the guide (update)

I have recently finished writing the third part of this tutorial guide, look here for the table of contents for easy access.

Have you read everything? Comment / join our newsletter / read our other research posts!

2024 Professional Guide to Market Research: Learn, Plan, and Succeed in Marketing (part 2/3)

January 29, 2024

0 Comments40 Minutes

2024 Professional Guide to Market Research: Learn, Plan, and Succeed in Marketing (part 1/3)

January 29, 2024

0 Comments32 Minutes