The year 2025 does not bring waves of enthusiasm to Romania’s construction and installation industry. On the contrary, many entrepreneurs and decision-makers seem to have their foot on the brake. Not completely, but certainly not enough to press the accelerator either.

Together with Uniprest Instal, the MKOR team carried out a complex study analyzing how industry players perceive challenges, investments, digitalization, and sustainability. The study was conducted with 100 decision-makers from companies with a turnover of over 2 million euros, active in construction processes and real estate development, installations, technical systems, design, and consulting.

The Goal?

To understand how 2025 is viewed from within this industry and which directions truly matter for those who, day by day, are building Romania.

Full access: Download the report “Construction & Installation Market in Romania, 2025” – and discover the study’s results for free

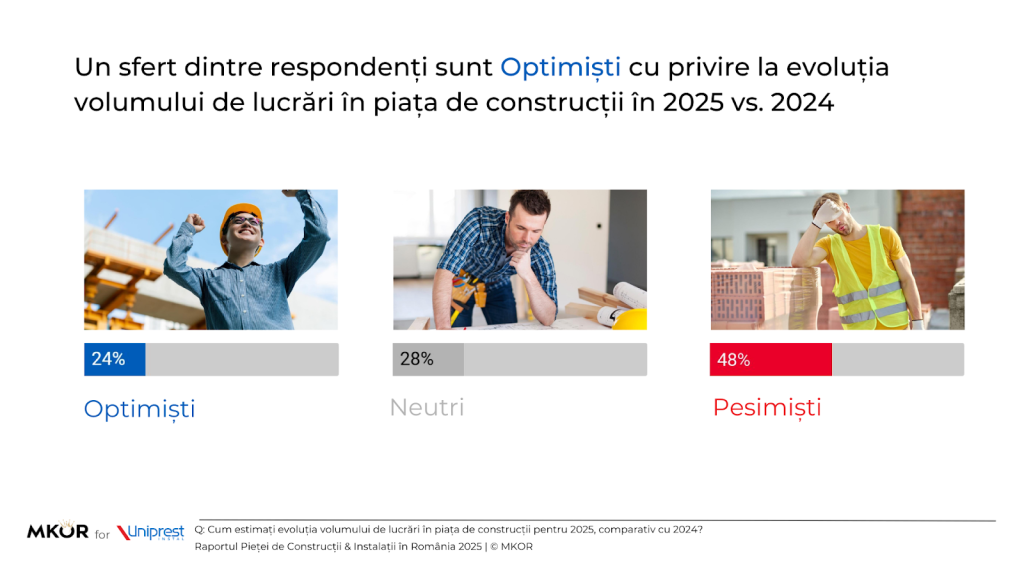

Only 1 in 4 Companies Is Optimistic. The Rest… Waiting for Less Uncertain Times

Only 24% of the companies surveyed estimate a positive evolution in work volume in 2025 compared to the previous year. Meanwhile, 48% are pessimistic, and 28% adopt a neutral stance.

Analyzing these results, we can say we are not facing a market in crisis, but rather one in restraint. While the pessimistic perspective is most popular (48%), industry professionals do not anticipate major disruptions, but rather adjustments in work volumes for 2025 — indicating a tendency toward stagnation and caution.

Mixed-use projects top the list of medium-term demand expectations (34%). Asked which types of projects will see the highest demand in the next 3–5 years, respondents pointed primarily to mixed projects — those combining multiple usage types (e.g., residential and commercial).

These are followed by public projects (schools, hospitals, administrative buildings) — 24% — and industrial projects — 17% — suggesting a diversified market, yet cautious in medium-term choices.

Energy Efficiency and Digitalization Are the Dominant Trends

When it comes to innovation, companies show high expectations: 7 out of 10 anticipate that in the next 3–5 years, the following will be widely adopted:

- Energy efficiency solutions,

- Digital management platforms,

- Energy recovery systems,

- Advanced automation.

Professionals involved in mixed-use projects appear the most receptive to innovation, especially regarding the integration of smart technologies in buildings. By contrast, the residential sector is advancing more slowly toward digitalization, with a greater focus on IoT solutions and management platforms.

Across all types of projects, user comfort is a top priority — reflected in the increased demand for ventilation and air-quality improvement solutions. In the industrial sector, priorities include energy efficiency and energy recovery solutions, alongside systems for reducing specific energy consumption.

The most frequently preferred solutions for implementation are: energy-efficient lighting (64%) and solar panels (62%).

Efficiency: Between Ideal and Reality

“Efficiency in installations” is spontaneously associated with “energy efficiency” by one-third of respondents. Other frequent associations include:

- Cost optimization,

- Use of modern technologies,

- Durability and reliability.

However, in practice, the biggest resource losses occur due to design errors (47%) and unforeseen technical changes (53%) — precisely in the early stages of projects.

Free access: Download the report “Construction & Installation Market in Romania, 2025” – and discover the study results

Sustainability – A Road Still Under Construction

Legal requirements on sustainability are becoming increasingly strict across Europe, and Romania is no exception. In this context, we assessed the perception of construction and installation companies regarding their preparedness to comply with these regulations.

The average score obtained was 4.6 out of 7, indicating an intermediate level of preparedness — a sign that the industry is on the right track, but more steps are needed to integrate sustainability as a standard practice.

A more detailed analysis reveals discrepancies between regions and sectors of activity:

In Bucharest-Ilfov, 25% of companies say they are already well-prepared, while 63% are in a medium stage of adaptation. This result may reflect higher competitive pressure in the capital, but also easier access to information, specialists, and resources.

In contrast, in the South-West and West regions, 41% of companies state they are not prepared at all for sustainability requirements. This regional gap raises questions about the uniformity of access to know-how and technical support in the field.

From the perspective of sectors, Construction and Real Estate Development companies are more optimistic (29% consider themselves well-prepared, only 17% say they are not), while companies specialized in Installations and Technical Systems are more skeptical, with the highest share of low scores (27%).

These differences suggest that the adoption of sustainability is still fragmented and depends heavily on local factors, resource availability, and the specific activity profile of each company.

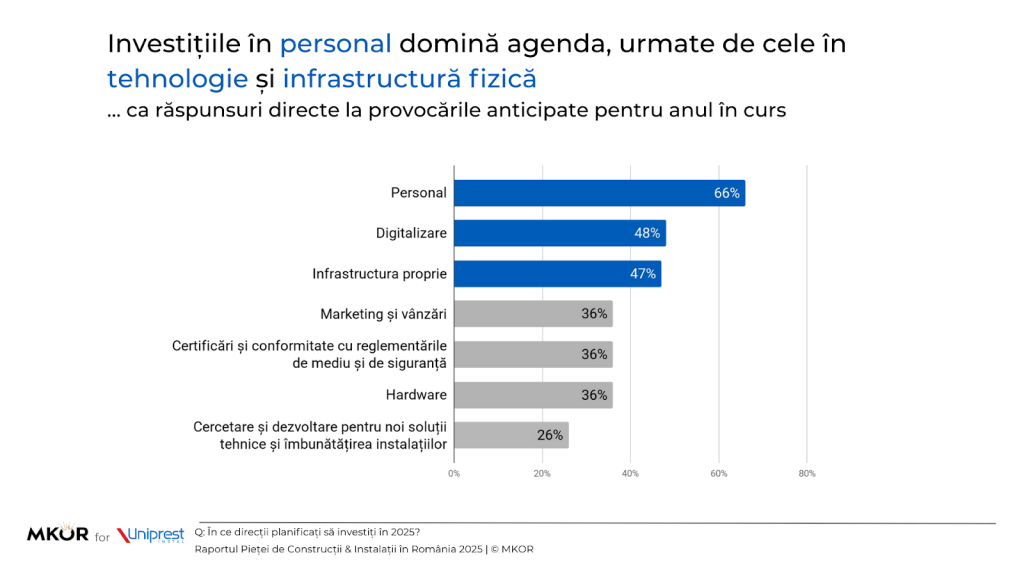

Investments in 2025: In People, Digitalization, and Equipment

More than 9 out of 10 companies (92%) in the construction and installation sector state that they will make investments in 2025.

66% of companies plan to invest in human resource development, reflecting the pressure felt due to the shortage of skilled labor. From technical training to managerial development, firms are seeking to strengthen internal teams in order to deliver projects more efficiently.

48% of companies are investing in digitalization — either through the adoption of new platforms or the modernization of existing processes. The goal? Greater efficiency and operational flexibility, in a market where rapid adaptation can make the difference between stagnation and growth.

47% allocate budgets for physical infrastructure, signaling that firms are pursuing stability through asset consolidation — ranging from equipment and machinery acquisitions to the modernization of logistics and operational spaces.

Companies with turnover between 5–10 million euros have the most diversified plans — on average, they invest in 3.6 directions simultaneously, demonstrating a balanced, strategic approach. The main focus falls on human resources (77%) and equipment (54%).

Companies in the installation sector stand out through their interest in research and development (36%), a sign of a stronger orientation toward innovation and emerging technologies.

Free Full Access: Download the report “Construction & Installation Market in Romania, 2025” – and discover the study results

The Future Demands Clarity, Vision, and Action

The year 2025 brings uncertainty, but also clear opportunities. To move forward, companies in the construction and installation sector need:

- Strategic investments in digitalization

- Genuine adoption of sustainability principles

- Legislative and economic clarity

- Discipline in execution, not just the desire for change

We Live in Uncertain Times, and Good Decisions Are Made Based on Data. MKOR Can Help You.

At MKOR, we dedicate ourselves to market research with a clear goal: to provide companies with the information they need to make strategic, well-founded decisions.

We deliver valuable insights about the Romanian market, analyzing consumer behavior, customer perceptions, and competitive dynamics. Whether you want to explore a new business direction, launch a product, or assess your current positioning, we support you with clear and relevant data.

In the Services section, you can discover the types of studies we conduct — from qualitative and quantitative research to brand tracking, market segmentation, or customer journey studies.

Browse our portfolio to see which organizations we have collaborated with and which successful research projects we have delivered.

Why is it worth investing in a market study?

A well-executed study helps you:

- Gain in-depth understanding of your clients and partners

- Anticipate market changes

- Validate strategic decisions

- Improve your performance in sales, communication, and business development

In a constantly changing business environment, access to the right data can make the difference between stagnation and growth. That is why the real question is not whether you can afford to invest in a study, but whether you can afford to move forward without it.

If you want to better understand what is happening in your niche, contact us. We will show you how we can build together a market research project that supports your business objectives.

Have you read everything? Comment / join our newsletter / read our other research posts!

Employee Sentiment 2023: Key Insights into Romania’s Labor Market

November 18, 2024

0 Comments5 Minutes