Before taxes, cut privileges – the clear message from Romanians in MKOR’s latest study

On a summer terrace in Bucharest, a young mother calculates the family budget: colored pencils for school, the apartment installment, and the increasingly heavy grocery bill. Just a few dozen kilometers away, in Prahova, a retiree watches a TV talk show about “new taxes” and sighs: “They’ll take it from us, not from them.”

Different in generation and lifestyle, yet both reach the same pressing question: where does the money we pay to the state actually go?

This is precisely what we set out to discover at MKOR.

Between June 20–22, 2025, we surveyed 1,250 Romanians, nationally representative, assessing trust in institutions, information levels, and the concerns triggered by the fiscal package announced by the Government.

The findings are striking: 3 out of 4 respondents do not believe that additional revenues will be spent efficiently, while 64% fear an immediate rise in prices through an increase in VAT.

Against a backdrop of systemic distrust and fragmented information, public opinion draws a clear red line: before asking for more money, the state must demonstrate efficiency and transparency.

This is not just a story about taxes, but about the social contract between citizens and the state.

When both sides no longer speak the same language, suspicion grows, spaces fill with doubt, polarization deepens, and mistrust sets in. The following article examines these fears in greater detail: from citizens’ perception of fairness in taxation, to the need for greater transparency in spending, to the erosion of trust in a state perceived more as a collector than as a provider of services.

Content

The issue is not taxes, but trust. When 3 out of 4 Romanians do not believe the state will spend money properly, we are speaking about a legitimacy crisis, not just a fiscal one. That is why we conducted this study 100% independently: to put clear numbers behind the emotions in society and to provide decision-makers with a true compass, not campaign ammunition.

Cori Cimpoca – MKOR Founder

Institutions in Freefall of Credibility

The Government, Parliament, and political parties receive alarming verdicts: average scores between 2.5 and 2.1 on a scale from 1 to 7, with nearly half of respondents directly assigning the lowest score, 1.

This is essentially a red card for the political class, at a time when it is asking citizens for additional fiscal effort.

At the opposite end, everyday institutions – schools (4.7), the healthcare system (4.0), and even private companies (4.3) – still benefit from a minimum level of trust.

The police, banks, and the National Bank of Romania occupy the middle ground (3.7–3.9), signaling cautious tolerance rather than genuine enthusiasm.

The divide is clear: the more an institution depends on political will, the lower its trust score falls – precisely the equation that fuels skepticism about how money from new taxes would be spent.

Without a reset of transparency and accountability, any debate about fiscal increases starts off burdened by a significant deficit of legitimacy.

In the following section, we will see how well (or poorly) Romanians are informed about the new fiscal measures, and how education level shapes the way each segment receives messages about money.

How well are Romanians informed about the new fiscal measures?

Only 1 in 3 Romanians consider themselves well-informed (scores 6–7), while 1 in 5 admit they know almost nothing. The national average is 4.37 – a fragile midpoint that conceals large gaps in knowledge.

| Level of Information | % respondents |

| 1 – Not at all informed | 10% |

| 2 | 8% |

| 3 | 12% |

| 4 | 17% |

| 5 | 19% |

| 6 | 15% |

| 7 – Very well informed | 17% |

1. The “Informed Core” – Small but Vocal

Managers, entrepreneurs, and individuals with higher education and higher incomes form about 15% of the population, scoring an average of 5.0 on the information scale.

They dominate talk shows, business networks, and public debates – but they do not represent the majority.

2. Information Grows with Age

The level of information increases by generation:

- Gen Z (18–26 years) – average 4.0

- Millennials – 4.3

- Gen X – 4.5

- Baby Boomers (56–65 years) – 4.7

Young people are more engaged when the topic directly affects their interests (jobs, cost of living, sustainability).

3. Trust Fuels Information – and Vice Versa

Romanians who believe the Government spends money efficiently score an average of 4.9, compared to only 4.2 among non-believers. Transparency and proactive communication could therefore transform skepticism into genuine attention to fiscal details.

In the absence of these, the new fiscal measures are perceived as an arbitrary tax increase, even before reaching Parliament.

As we will see below, in exchange for greater trust and better information, Romanians set a clear precondition: cut privileges and curb waste before any new tax discussions.

The First Demand from Citizens to the Government: Cut Privileges

When asked to name a single concrete gesture that would prove the state is serious about budget discipline, Romanians’ answers were unequivocal:

- 29%: First step should be cutting special pensions

- 19%: Curbing waste and corruption

- 14%: Eliminating large subsidies and sponsorships for political clientele

More than half of Romanians (62%) say the same thing, in different words:

Stop privileges before asking us for more money.

Who Sees Reform Differently

- Managers and entrepreneurs do not shy away from unpopular measures. Only 19% want special pensions to be eliminated, but 10% demand the dissolution of local councils. They favor structural reforms, not just symbolic cuts.

- Employees are more concerned with the visible impact on salaries and the size of public administration (18%). Budget cuts, privatizations, and fewer agencies (9%). The public–private conflict remains a dividing line.

Education Changes Slowly

Those with higher education are more likely to want pensions and visible salaries cut. Interest in combating waste rises with education – 12 percentage points above the national average.

In general, university graduates want systemic solutions such as better tax collection and administrative reform.

Without Trust, There Is No Mandate

Among Romanians who believe the state spends money poorly, punitive measures dominate: 21% want tougher penalties for waste and corruption.

The rest? Distrust is the fuel for protest claims. Without transparency, even a new tax has no chance of being accepted.

Generational Differences

- Gen Z wants a modern state: investments funded by the European Union (+6 pp vs. average).

- Baby Boomers call out the state on fiscal issues: they demand efficient collection of existing taxes (+7 pp).

Different generations, same conclusion: reform must begin inside the system, not from citizens’ wallets.

Morality?

The government cannot raise the issue of higher taxes without first proving that privileges have been cut. And this is not a campaign slogan, but a matter of legitimacy, supported by more than half of the population. Only once waste becomes the exception, not the rule, can conversations begin about new sources of budget revenue.

Top 3 Fiscal Measures That Frighten the Population

The shopping basket, the bank loan installment, the utility bill. This is where the real struggle is felt.

Here are the measures that most threaten the cost of living, in order of collective fear:

- VAT increase to 21% – 64% of Romanians raise their eyebrows.

A loaf of bread more expensive, a full tank of gas pricier. Every extra leu taken from their wallets feels personal.

Even small increases at the bottom add heavy weight.

Among those who believe the state does not spend money wisely, the share of the concerned rises to 68%. For them, this is not just a tax, but a lost bet from the very start.

- Removing the price cap on basic food products – 42% feel their refrigerators are under siege.

We are not talking about luxury goods, but milk, oil, flour.

Low-income households and families with children are hit first.

For a single mother in Botoșani, one extra leu on a liter of oil means the dessert for an entire week is cut from the menu. That is not easily forgotten.

- Tax on financial transactions – 32% fear taxes will eat away at their bank accounts.

Fewer people, but much more vocal. Managers, entrepreneurs, and those with solid savings see this measure as punishment for prudence.

The discussion quickly moves beyond costs to principle: Why should savers be penalized, instead of those who evade and break the rules?

The Urban–Rural Divide Adds a Layer of Unease

In rural areas, the very idea of a progressive income tax raises anxiety by 10 percentage points compared to cities. In urban centers, the threat may feel abstract, but in villages, it translates directly into fewer resources for household needs or fuel for the tractor.

And yet another sign of the times: Gen Z is closely watching the carbon tax, with sharper attention than the national average (14% vs. 8%). For them, climate risk and fiscal risk are part of the same story.

In the End, Numbers Do Not Lie

The fear of rising costs outweighs any technical discourse on budgetary balance. As long as Romanians do not see a state cutting wasteful spending, every new tax increase is hard to accept.

Who Should Pay More? Public vs. Private Sector Conflict

When asked, Who do you think should contribute more to increasing state revenues?, the most frequent answer is: Privileged public sector employees.

Four in ten Romanians did not hesitate: 46% say the bill should start with special pensions and the generous bonuses of the public system.

The data confirm:

- Private sector employees put maximum pressure – 50% point to the privileged.

- Public sector employees feel targeted and respond with a different philosophy: 20% support proportional contributions for all, double the share of the private sector.

Trust Enters the Equation

Those skeptical of how the Government spends public money point directly to public sector privileges: 50%.

Among those who no longer believe in government, the percentage drops sharply to 35%. When you double the money you take, but don’t use it properly, the sacrifice is demanded from the base of the pyramid, not its top.

A Surprise from Gen Z

About 37% of young people accuse public employees (+9 pp vs. the average), but 13% place more pressure on those with very high incomes from the private sector, double the national average. For them, injustice goes beyond the state—the privileged also include corporate salaries.

Income Shapes the Perception of Fairness

Those with much tighter budgets are five times more likely to want higher taxation of large private sector fortunes (10%) compared to those with higher incomes (2%).

Each voice filters justice through its own lens.

The Urban–Rural Divide Reflects Civility

Rural residents, more dependent on state spending, want to see the public bill reduced by cutting state costs (51% vs. 45% urban). The urban population is more attentive to multinationals (12% vs. 6% rural).

In Short, Who Pays Is Not Just a Matter of Arithmetic

It is a huge fight across the public–private divide, across trust, and across how each group sees the fiscal burden. And when respondents are given the option Privileged public sector employees (special pensions, bonuses), the split looks like this:

- Private vs. Public: 50% vs. 39% – a gap in legitimacy.

- Distrust vs. Trust: 50% vs. 35% – the bill starts with rebuilding trust.

- Young vs. Old: 37% vs. 50% – the blame shifts from the bottom to the top.

- Rural vs. Urban: 51% vs. 45% – the state is more present in villages, so it should cut spending first.

Thus, the answer to the tax dilemma is clear: any new tax is heard like an alarm bell.

Romanians speak loudly: start with your own costs, then knock on our door.

How Romanians Adapt Their Finances to New Taxes

When news of higher VAT and long lists of new taxes broke, Romanians did not wait for Parliament’s vote.

They created their own mini crisis-plans.

The immediate reflex: cut daily costs. Five in ten say they will look for cheaper alternatives for everything in their basket—from detergent to internet. Just as many promise to shrink their weekend budgets: fewer outings, shorter vacations.

The second step affects bigger aspirations. One in three postpones major purchases: car, television, refrigerator. “Maybe tomorrow, not today” has become the new motto. Another one in three plans to set aside money “for hard times.”

Saving is back in trend, especially among the young: Gen Z is leading, with 46% setting aside every leu.

For some, defensive measures are not enough. Two in ten are actively looking for better-paying jobs. This is particularly the case for private-sector employees and those without children, ready to switch offices for a higher salary. Another 17% plan to take on side jobs or freelance work—a sign that the labor market is becoming the main battleground of adaptation.

Strategies shift depending on status.

- Managers and entrepreneurs cut leisure expenses by 64% and treat vacations as a negotiable luxury.

- At the other end, employees focused on income: 25% are hunting for a better-paid job, even if it means rewriting their CV from scratch.

The public sector remains more static.

Only 12% of public employees would change jobs, compared to 27% in the private sector. Job security outweighs risk. Baby boomers confirm this: only 8% would embark on a new career; instead, they prefer to slow down spending and hope for better times.

Trust (or lack thereof) colors all these decisions. Those who believe the state will spend wisely are twice as likely to say they would not change anything. The rest activated “self-rescue mode” back in June.

In short, the portrait of taxpayers in 2025 looks like this: tight budgets, postponed major plans, job hunting on the rise, and for those with resources—discreet investments in energy efficiency (8%).

It is a mix of defense and offense, shaped by age, income, and by how much (or little) confidence remains that our money will return to us through public services.

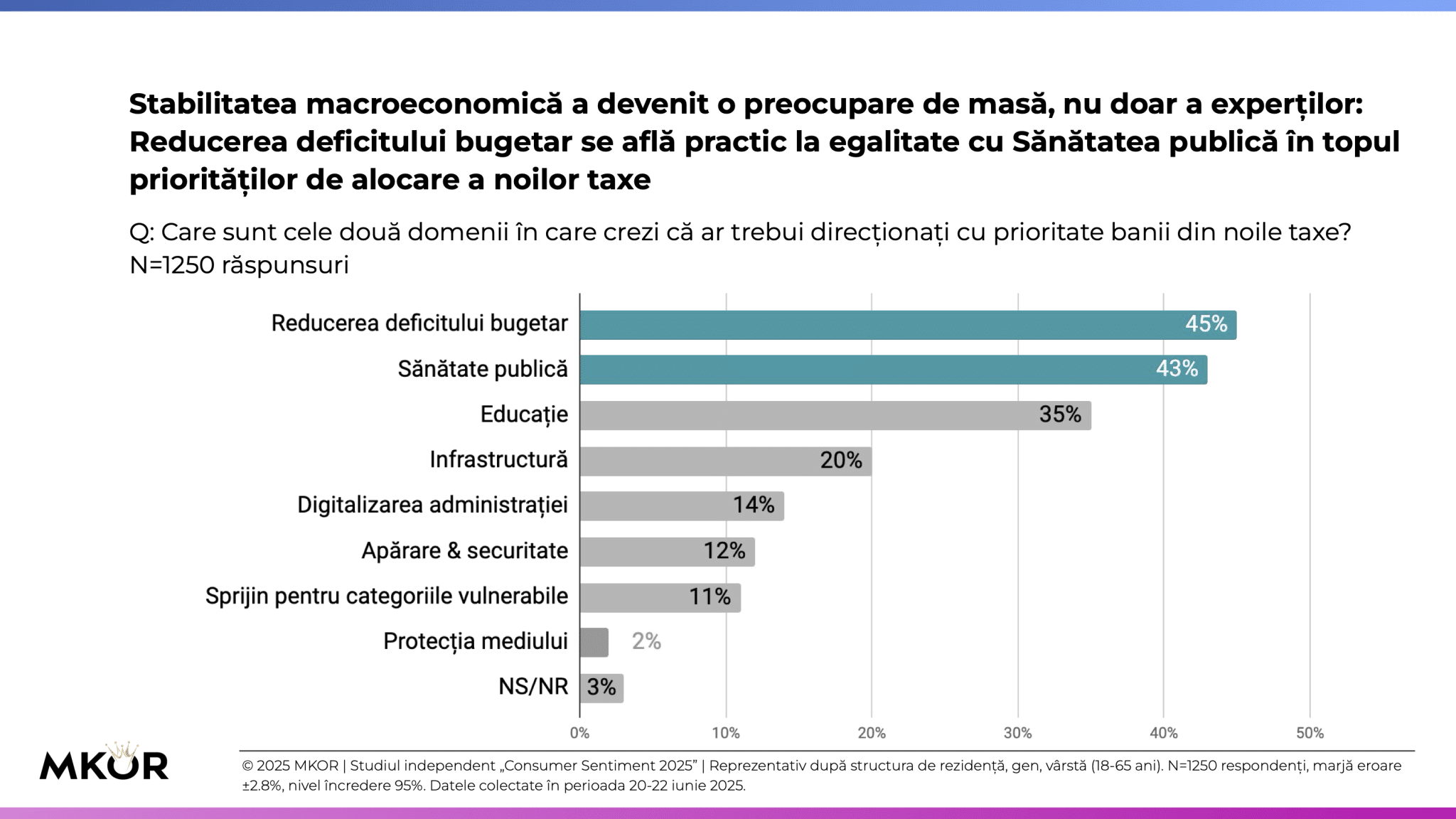

Where Taxpayers Want Their Money to Go

Surprisingly, public opinion is not united, but split almost evenly between two registers: healing the budget deficit versus investing in daily life.

- 45% of Romanians would prioritize directing funds toward reducing the deficit, citing macroeconomic stability as a national urgency.

- 43% demand, above all, better funding for public healthcare.

- In third place comes education (35%).

- Only afterward appears infrastructure (20%).

- Digitalization of public administration (14%).

- Defense (12%).

Looking at different segments, we can observe the following:

- Macro / Micro Divide. University graduates and those with high incomes vote for financial discipline: 52% and 50% choose deficit reduction. Those with less schooling and lower incomes respond viscerally to immediate needs: 52% healthcare, 48% education.

- Gender shifts the priority list. Women put at the top the systems that affect families directly—healthcare 51% and education 40%; men look to infrastructure: 25% vs. 14% for women.

- Life cycle moves the emphasis. Parents with young children raise their hands for education (44%), while older generations who are past childcare concerns press the pedal on deficit reduction (50%).

- Age brings caution. Baby Boomers lead with 55% for a smaller deficit; Millennials, in the midst of family expenses, call for hospitals and schools: 47% healthcare, 42% education.

- Trust shapes the time horizon. Those who believe the state can spend money wisely are willing to invest long term—40% education. Those who distrust turn toward quick accounting fixes and lean on deficit reduction.

Behind these figures lies a deeper tension: people want, simultaneously, a healed budget (deficit reduction) and a rebuilt future (healthcare, education).

Strategic decisions often ignore one of these two impulses, but 2025 taxpayers will demand both.

Conclusions & Key Insights

1. Distrust is the Key Barrier

75% of Romanians start from the premise that the state wastes the money it collects. Any fiscal project begins with a legitimacy handicap.

Without clear guarantees of transparency and efficiency, the discourse of tax necessity has no ground to take root.

2. Reform First, Then the Bill

62% demand the elimination of special pensions, tackling tax evasion, and capping high public-sector salaries before any tax increases.

For the public, the fiscal package is no longer a set of figures, but a test of fairness and political will.

3. Cost of Living Outweighs Budgetary Calculations

The VAT hike to 21% (64%) and the removal of the food price cap (42%) are the biggest fears.

When Romanians calculate their own daily basket, any argument about fiscal sustainability fades into background noise.

4. Public–Private Conflict Deepens

One in two private-sector employees want the tax burden to fall on privileged public employees, while 39% of public employees are ready to shift the blame.

As long as waste is not cut, the public sector will remain stuck in the perception of not stability, but privilege.

Methodology and How We Conducted the Research

At MKOR, we treat every figure as a promise of accuracy. To faithfully capture Romania’s fiscal pulse in mid-2025, we followed a solid methodological protocol, aligned with ESOMAR standards.

| Collection period | 20 – 22 June 2025 |

| Target | General population aged 18–65, Romania |

| Sample | N = 1250 respondents, nationally representative by region, gender, and age |

| Method | Online CAWI survey, via MKOR’s proprietary panel |

| Margin of error | ±2.8%, at a 95% confidence level |

| Weighting | Post-stratification based on the latest INS data; adjustments for survey participation and response behavior |

| Quality control | Post-stratification based on the latest INS data; adjustments for survey participation and response behavior |

No part of the research was financed or influenced by any political actor. MKOR fully covered the costs, ensuring both the independence of results and the freedom to publish the full raw dataset in the complete report.

Press Coverage & Public Visibility

Since the publication of the results, the study Consumer Sentiment Q2 2025 – Perceptions and Behaviors Ahead of Elections and Economic Changes quickly made the rounds in the media.

The national agency AGERPRES opened the English-language newswire with the headline “Three in four Romanians do not believe money from new taxes will be spent efficiently by Government” (agerpres.ro), while Hotnews highlighted the same key idea, emphasizing Romanians’ demands (hotnews.ro).

Over 57 economic newspapers and TV stations picked up our insights, confirming that fiscal distrust is the topic of the moment.

Below, you can also see the Euronews Romania segment where MKOR’s figures were presented by their reporters.

Why Does It Matter?

Media visibility is not just a source of pride; it is proof that solid data can shift the public conversation.

When journalists ask informed questions, decision-makers can no longer avoid giving answers.

Let’s Work Together

If you want to make decisions based on reality—not impressions—MKOR is your research partner.

- Validated Precision – the most accurate poll in the 2025 presidential elections, and now the same level of rigor applied to fiscal research.

- Transparent Methodology – we publish the margin of error, sample structure, and full crosstabs, ensuring that conclusions withstand any audit.

- Agile Research – we deliver actionable insights in days, not months, whether you are targeting consumers, employees, or the general public.

- Impactful Consultancy – we turn datasets into clear, strategic recommendations, adapted to business or policy contexts.

Want to know how we can help?

Write to us, and let’s transform data into decisions that truly matter.

Have you read everything? Comment / join our newsletter / read our other research posts!

MKOR Survey: Romania Votes for Its Future in the Second Round of the 2025 Presidential Elections

September 11, 2025

0 Comments28 Minutes

Urban Millennial Moms Are the Face of the Ethical Consumer Profile in Romania

April 19, 2024

0 Comments16 Minutes

Fashion ROute 2022: data extracted from the first real-time Romanian fashion retail study

August 12, 2022

0 Comments10 Minutes

How it went at the IQ Digital launch: the initiative supporting Romanian SMEs for free

January 24, 2026

0 Comments6 Minutes