The Romanian Patient Map: 4 out of 10 are “Reactionaries”, trapped in the vicious cycle of cost and fear

A smile is a calling card, and oral health, a pillar of overall well-being. We know this in theory. In practice, however, for most Romanians, the dental office remains a territory visited only in case of crisis, not as part of a preventive routine.

To understand what lies behind this reactive culture, the MKOR team conducted an in-depth study on Romanians’ habits and perceptions regarding dental care. Our analysis went beyond simple percentages and revealed something much more important.

In Romania, there isn’t just one type of patient, but four completely distinct profiles, each with their own fears, motivations, and barriers.

The purpose of this study?

To debunk myths and provide a faithful “radiography” of dental health in Romania. We aimed to understand what motivates them, what scares them, and, most importantly, what drives Romanians to act, in order to offer actionable insights to clinics and brands in the industry.

Content

This study is a mirror. It transcends the boundaries of dentistry and shows us how fragile the culture of prevention actually is in Romania. The decision to publish these data in full is our contribution to a broader discussion: how do we shift from a “fix what’s broken” mentality to one of “building long-term health”?

Cori Cimpoca – MKOR Founder

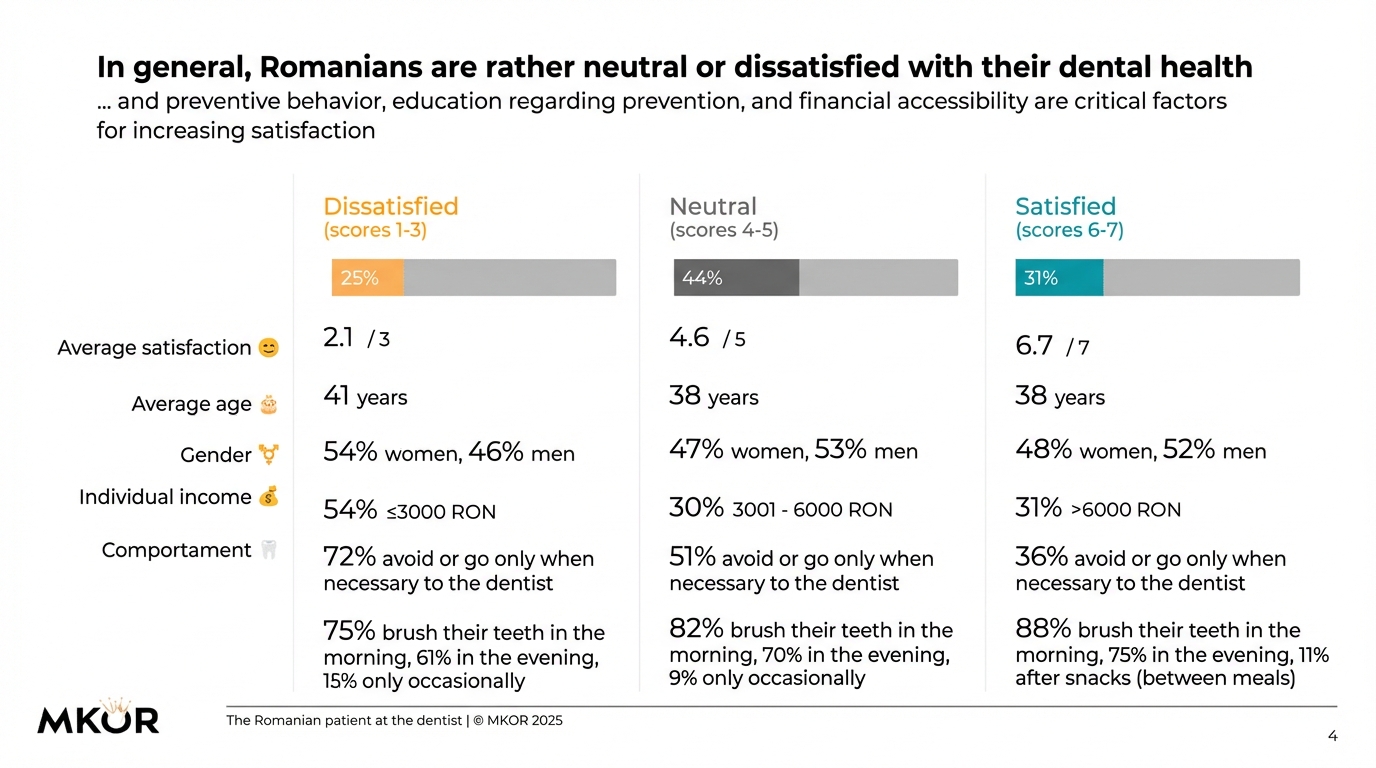

How Behavior, Not Demographics, Defines Dental Health

The first and most important conclusion of our study is that the profile of dental care in Romania can be analyzed based on four distinct behavioral segments. Age, gender, or place of residence (urban/rural) do not dictate attitudes towards dental health, but rather how each individual chooses to approach prevention.

Here’s how the four segments of the Romanian population look from an oral health perspective:

1. Active Preventives (12% of the population)

This is the ideal segment: disciplined patients who go for check-ups or cleanings every 6 months or more often.

They are the most satisfied with their dental health (average score of 5.2 out of 7) and, because they address problems early, they end up investing intelligently.

hey are the most open to elective treatments, such as braces (13% vs. 3% average). Their profile is defined by higher education and above-average incomes.

2. Passive Preventives (36% of the population)

This represents a major segment, comprised of those who visit the dentist once a year or less frequently, but still for preventive purposes.

They are relatively satisfied with their condition (score of 5.0 out of 7) and form the patient base for maintenance services (64% undergo scaling).

Although they lack the discipline of the “active” segment, they understand the importance of prevention and represent a public with huge potential for education and activation.

3. Reactionaries (38% of the population)

The largest segment (almost 4 out of 10 Romanians) consists of patients who visit the dentist exclusively when a specific problem arises, such as pain, a visible cavity, or an emergency. For them, the dentist is a “repairer,” not a long-term partner. This reactive behavior directly reflects in their health status:

- satisfaction levels drop dramatically (average score of 4.3)

- treatments performed are out of necessity: fillings (48%) and extractions (31%)

4. Avoiders / Absentees (13% of the population)

This segment is trapped in a vicious cycle. They either avoid going to the doctor even if they have problems (3%), or they haven’t been at all in the last two years (10%).

The consequence is predictable: they are the most dissatisfied with their dental health (average score of just 3.5 out of 7) and have the highest inactivity rate, with 100% of them having undergone no dental treatment in the last 2 years.

Those who avoid the doctor are 24% more dissatisfied than the average, while preventives are 19% more satisfied. Thus, prevention is not just a medical concept, but the main driver of oral health well-being.

Cost, a Major Barrier: 6 out of 10 Romanians Postpone Dentist Visits

If understanding the four behavioral segments is the map, then analyzing the barriers shows us where the roadblocks lie. And the biggest obstacle, by far, is financial.

Generally, 61% of Romanians – that is, 6 out of 10 – state that they postpone or avoid dental visits due to perceived high costs.

However, just like with behaviors, this massive percentage hides a much more nuanced reality. Price is not a universal barrier, but one that draws a clear social and economic demarcation line.

Detailed analysis shows that cost pressure is acutely felt by already vulnerable segments:

- It is the main reason for 75% of respondents dissatisfied with their dental health, fueling the vicious cycle of postponement

- It represents a critical problem for 70% of parents with adult children (a segment associated with Generation X and accumulated dental problems)

In contrast, the financial barrier is notably lower for segments with high socioeconomic status. Only 44% of managers and entrepreneurs and 52% of high-income earners mention it as the primary factor.

The study also reveals a significant difference in perception between genders.

Women are more sensitive to costs, with 67% of them indicating price as a reason for postponement, compared with 56% of men. These figures do not just describe a barrier, but define two parallel segments:

- a ‘dentistry of necessity’, where patients are trapped in a cost-driven logic and postpone until an emergency arises, and

- a ‘dentistry of value’, where patients with resources can prioritize quality, expertise and, implicitly, prevention.

From Price to Value: What the Ideal Patient Seeks and Why They Choose Expertise, Not Low Cost

If financial and psychological barriers define reactive segments, then the criteria for choosing a doctor reveal the profile of the ideal patient.

The study shows that once cost pressure disappears, the decision shifts from a logic of price to one of value, where expertise, technology, and experience become the decisive factors.

For the massive segment of Reactionaries, the choice remains pragmatic and cost-dominated: 55% of them choose their doctor based on affordable prices. They seek a quick and inexpensive solution to an existing problem. In contrast, for proactive segments, the equation changes fundamentally.

Active Preventives, for example, are significantly less interested in price (only 35% mention it, 14% below average). For them, the quality of medical care is paramount, and this is evident in their top criteria:

- The dentist’s experience and professionalism (48%) becomes the main decision-making factor

- Hygiene and sterilization standards (36%) are essential, 12% above the general average

This model is also confirmed by the higher socio-economic segment. Managers, entrepreneurs, and high-income individuals, who can view oral health as a long-term investment, prioritize factors that guarantee quality and efficiency:

- Modern equipment and technology (26-31%) are an important differentiator

- The dentist’s expertise (43%) is a non-negotiable criterion

Essentially, the data reveals two parallel strategies.

- to attract the reactive majority, a clinic must compete on price and accessibility

- to build a portfolio of loyal and profitable patients, differentiation is achieved by communicating value: proven expertise, cutting-edge technology, and an impeccable in-office experience

Beyond Cost: Fear, Lack of Time, and the “Shield” of the Young Complete the Picture

Once we move past the financial obstacle, the map of reasons why Romanians avoid dental visits becomes even more complex.

The study on the Romanian dental market shows that, beyond budget, the decision is strongly influenced by psychological factors and logistical constraints, which define public segments with fundamentally different needs.

Fear of pain (23%) is the second largest barrier, a deeply emotional one. However, the most relevant aspect is that it is not uniformly distributed: it peaks at 29% precisely among the segment already dissatisfied with their oral health.

A vicious cycle thus forms: poor dental condition fuels anxiety related to complex and painful interventions, which reinforces the decision to postpone the visit. At the opposite pole lies a pragmatic barrier: lack of time (16%).

If price is the problem for the vulnerable, time is the luxury of the busy. This reason is specific to parents with minor children (22%), managers (21%), and high-income earners (23%). For them, the problem is not financial accessibility, but the efficiency and flexibility of services (quick appointments, extended hours).

A third important reason is, in fact, a rationalization: 24% of respondents state that they do not visit the doctor because they “haven’t had significant problems.” This is the shield of the young and (still) healthy.

This justification is used by 41% of young people from Generation Z and 40% of those satisfied with their dental health, but only by 9% of those dissatisfied.

This is not a real barrier, but a mentality that blocks the transition to prevention, representing a major challenge for educational campaigns.

From Price to Value: What the Ideal Patient Seeks and Why They Choose Expertise, Not Low Cost

If financial and psychological barriers define reactive segments, then the criteria for choosing a doctor reveal the profile of the ideal patient. The study shows that once cost pressure disappears, the decision shifts from a logic of price to one of value, where expertise, technology, and experience become the decisive factors. For the massive segment of Reactionaries, the choice remains pragmatic and cost-dominated: 55% of them choose their doctor based on affordable prices. They seek a quick and inexpensive solution to an existing problem. In contrast, for proactive segments, the equation changes fundamentally. Active Preventives, for example, are significantly less interested in price (only 35% mention it, 14% below average). For them, the quality of medical care is paramount, and this is evident in their top criteria:

- The dentist’s experience and professionalism (48%) becomes the main decision-making factor

- Hygiene and sterilization standards (36%) are essential, 12% above the general average

This model is also confirmed by the higher socio-economic segment. Managers, entrepreneurs, and high-income individuals, who can view oral health as a long-term investment, prioritize factors that guarantee quality and efficiency:

- Modern equipment and technology (26-31%) are an important differentiator

- The dentist’s expertise (43%) is a non-negotiable criterion

Essentially, the data reveals two parallel strategies.

- to attract the reactive majority, a clinic must compete on price and accessibility

- To build a portfolio of loyal and profitable patients, differentiation is achieved by communicating value: proven expertise, cutting-edge technology, and an impeccable in-office experience

General Context: Mediocre Trust in the Healthcare System Encourages a Culture of Reaction

The reactive behavior of Romanians towards dental health is not an isolated phenomenon, but a piece of a much larger puzzle: the general climate of trust in Romanian institutions.

Data from the latest MKOR Consumer Sentiment study, conducted in June 2025, shows that trust in the public healthcare system is mediocre, scoring only 4.0 out of 7.

This score places healthcare in a neutral, but fragile, zone. It is a level of trust superior to that granted to political institutions (Government – 2.5, Parliament – 2.3), but significantly below that of education (School – 4.7) or private companies (4.3).

Furthermore, the population is highly polarized: 36% of Romanians have low or very low trust in the healthcare system, while 40% declare high trust. What connection does this general climate have with dental visits? A direct one.

When trust in the “system” is shaky, citizens do not perceive it as a reliable partner for prevention and maintenance.

Health becomes a strictly individual responsibility, often managed in crisis and, most of the time, in the private sector.

This context directly fuels the profile of the “Reactionary,” who only consults a doctor when pain becomes unbearable, and that of the “Avoider,” who prefers not to interact at all with a system they do not consider predictable or trustworthy.

This trend is part of the broader landscape of Romanian consumer sentiment, which MKOR constantly monitors. You can explore more data in the study on Consumer Sentiment and trust in state institutions.

The Future of Dentistry: Education, Accessibility, and Segmented Communication

The MKOR study on dental health in Romania is not just a collection of statistics, but a map of patients, who operate at different speeds.

To navigate this complex landscape, clinics and brands in the industry must understand that they are not addressing a single audience, but rather segments with fundamentally different needs, fears, and expectations. The main strategic conclusions of the study are:

1. The market is divided into four behavioral “tribes”

The most important conclusion is that mindset, not necessarily demographics, dictates the relationship with the dentist.

From the “Active Preventive”, who sees health as an investment, to the “Absent Avoider”, blocked by psychological and financial barriers, each segment requires a distinct approach.

2. The socio-economic gap is real and defines two parallel segments

On one hand, we have a majority of the population trapped in a “dentistry of necessity,” where decisions are dictated by cost and the urgency of pain.

On the other hand, a “dentistry of value” is emerging, where patients with above-average incomes and education seek expertise, technology, and a superior experience.

3. “One-size-fits-all” communication is doomed to fail

Talking about cutting-edge technology to a “Reactionary” patient, whose primary concern is cost, is as ineffective as competing on price to attract a “Manager” who seeks expertise.

Success in 2025 will belong to dental clinics that segment their communication, addressing fear and financial barriers for some, and emphasizing quality and innovation for others.

The challenge for clinics in Romania is not just to offer quality treatments, but to become partners in dental education, adapting their message to transform fear into trust, cost into investment, and reaction into prevention.

How We Managed the Dental Care Market Research

- Sample Size: 1000 respondents

- Sample Characteristics: nationally representative for the urban and rural population, based on criteria of gender, age, and education level.

- Target: general population of Romania aged between 18 and 55 years.

- Research Method: opinion poll (CAWI).

- Instrument: online questionnaire.

- Approach: online, via the MKOR Panel.

- Period: October 1 – 5, 2025.

We Live in Complex Times, and Good Decisions are Made Based on Data. MKOR Can Help You.

At MKOR, we are dedicated to market research with a clear purpose: to provide companies with the data they need to make strategic, informed decisions.

Whether you want to deeply understand your clinic’s patients, explore a new service niche (such as aesthetic dentistry for the premium segment), or evaluate your brand in the market, we support you with clear and relevant studies. Why invest in a market study?

- Understand in detail the needs, fears, and expectations of your prospects and clients.

- Anticipate market changes and new consumer trends.

- Validate decisions related to prices, service packages, and communication strategies for each segment.

In an increasingly competitive market, the question is not whether you can afford to invest in a study, but whether you can afford to move forward without it.

If you want to better understand what’s happening in your niche, write to us. We will show you how we can build together a market research that supports your business objectives.

Have you read everything? Comment / join our newsletter / read our other research posts!

MKOR Consumer Sentiment Study: Principal Reasons for Romanian Concerns in 2023

April 16, 2024

0 Comments8 Minutes