MKOR’s latest market study provides buyers’ perspective on Black Friday. Key findings for 2025:

- The End of Impulsivity: A record 93% of buyers plan their purchases in advance, transforming Black Friday into a strategic event, not a spontaneous one.

- Budget Increases Substantially: Romanians are willing to allocate an average budget of 2046 RON, 33% more than the previous year, signaling increased confidence and better financial planning.

- The Rise of the Hybrid Shopper: Almost 4 out of 10 consumers (39%) desire a complete online-offline experience, a trend led by Generation Z, where 56% prefer to combine purchasing channels.

- From Tech to Lifestyle: The shopping cart is visibly diversifying. Fashion (42%) and Beauty & Care (42%) categories are making a strong comeback, nearly equaling traditional Electronics & Home Appliances (49%).

The mad dash for deals, frantic midnight clicks, and shopping carts filled at random. This image, once defining the biggest shopping event of the year, has become a myth in 2025. In its place, data from the new MKOR study reveals the portrait of a strategic consumer, who transforms shopping fever into a meticulous planning exercise.

The market study dedicated to the biggest shopping event of the year is a usage & attitudes tracker that MKOR conducts annually, continuing the series of analyses from 2024, 2023 and 2022.

The research is unique in Romania and provides essential data on the plans and expectations of Romanian consumers before Black Friday.

The analysis captures how purchasing intentions evolve and how buyers prepare, as well as how wishlists and purchasing preferences change from one year to the next. In addition, this year’s study includes an evaluation of the Black Friday 2024 experience, offering a complete picture of satisfaction and challenges from the previous year.

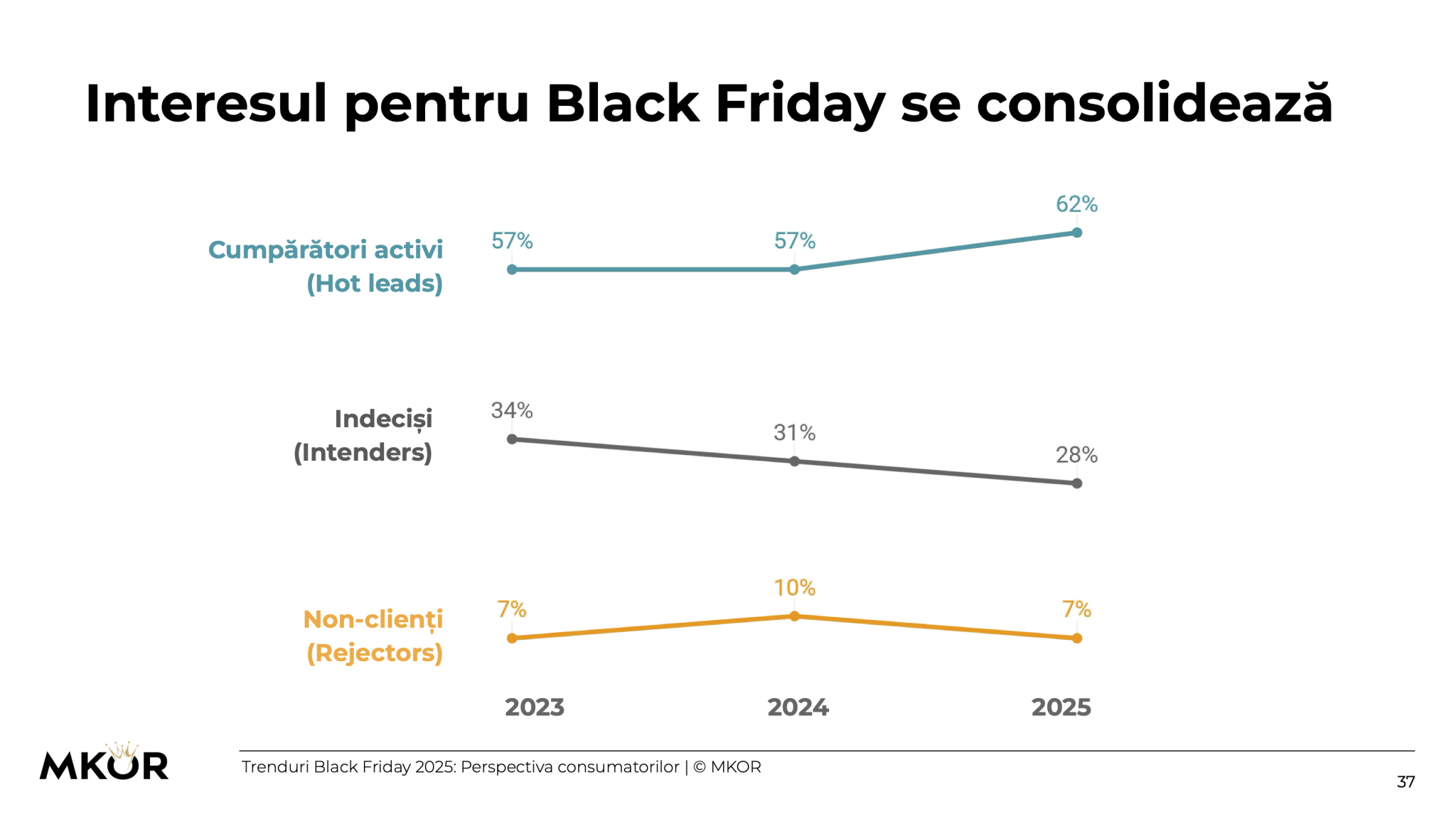

Although interest in Black Friday is consolidating, with over 6 in 10 Romanians (62%) intending to buy, the way they do so has changed radically. Impulse has given way to calculation: an overwhelming 93% of buyers plan in advance, and more than half (53%) strictly purchase products from a wishlist tracked over several weeks.

This article dismantles, point by point, old perceptions and outlines the real portrait of the Black Friday shopper in 2025: more of a strategist than a bargain hunter.

Conținut

This year’s data confirms an accelerated maturation of the Romanian consumer. Black Friday is no longer a sprint, but a planning marathon that often begins in October. For retailers, this means the battle is no longer just about price on day-X, but about building relevance and trust weeks in advance. Whoever understands they are selling to a strategist, not an impulsive hunter, will win in 2025.

Cori Cimpoca – MKOR Founder

Watch MKOR’s Black Friday Study Showcased on the ProTv morning news

* for optimum viewing experience in your language don’t forget to enable CC and set it to english 👇

Interest Consolidates: 6 in 10 Romanians Plan to Buy, and Gen X Recovers Ground

Far from losing steam, Black Friday is consolidating its position in Romanians’ shopping calendar. Purchase intent saw a notable increase in 2025, reaching 62%, compared to 57% in previous years.

This percentage translates to almost 6 million consumers determined to make at least one purchase.

Generation analysis shows that Generation Z (18-28 years old) remains the engine of enthusiasm, with an impressive 71% declaring they will take advantage of offers. They are closely followed by Millennials (29-44 years old), who form a solid buyer base, with an intent of 64%.

The surprise this year, however, comes from the segment considered more conservative. Generation X (45-55 years old), after a period of expectation, shows renewed interest in the event, with their purchase intent increasing from 47% in 2024 to 52% in 2025.

Furthermore, historical data shows that declared intent is often exceeded by actual behavior.

For example, in 2024, although only 57% of Romanians intended to buy, ultimately, 77% made at least one purchase. This discrepancy demonstrates that the massive group of undecided consumers (28% in 2025) is highly reactive to offers, representing immense potential that activates during campaigns.

Myth #1 Debunked: Romanians Don’t Buy Impulsively

If Black Friday was ever about spur-of-the-moment decisions, those days are over. The most powerful insight from the 2025 study is the near-complete disappearance of the impulsive shopper.

Data shows widespread planning behavior: an overwhelming 93% of those intending to make purchases prepare a list in advance. This process is not superficial.

For most, the hunt for deals begins long before November, with lists being drafted an average of 3-4 weeks before campaigns start.

But what exactly motivates this rigorous planning?

1. Targeted Hunt for Desired Products

The main driver, mentioned by 53% of buyers, is the desire to acquire products or services they have been tracking for a long time, at a better price. Black Friday has thus transformed into a strategic opportunity to check off items from a personal wishlist, not to randomly discover offers.

2. Planning Christmas Gifts

Pragmatism also dominates the gift area. Almost one-third of buyers (31%) use the discount period to purchase gifts for the winter holidays in advance, thus optimizing their budget.

3. Defense Against Inflation

A new but rapidly growing reason is the fear of future price increases. 13% of respondents say they are stocking up on certain products, in the context of inflationary pressures and fiscal changes. This behavior, which has almost doubled compared to the previous year, is a clear indicator of how the macroeconomic context directly influences consumer decisions.

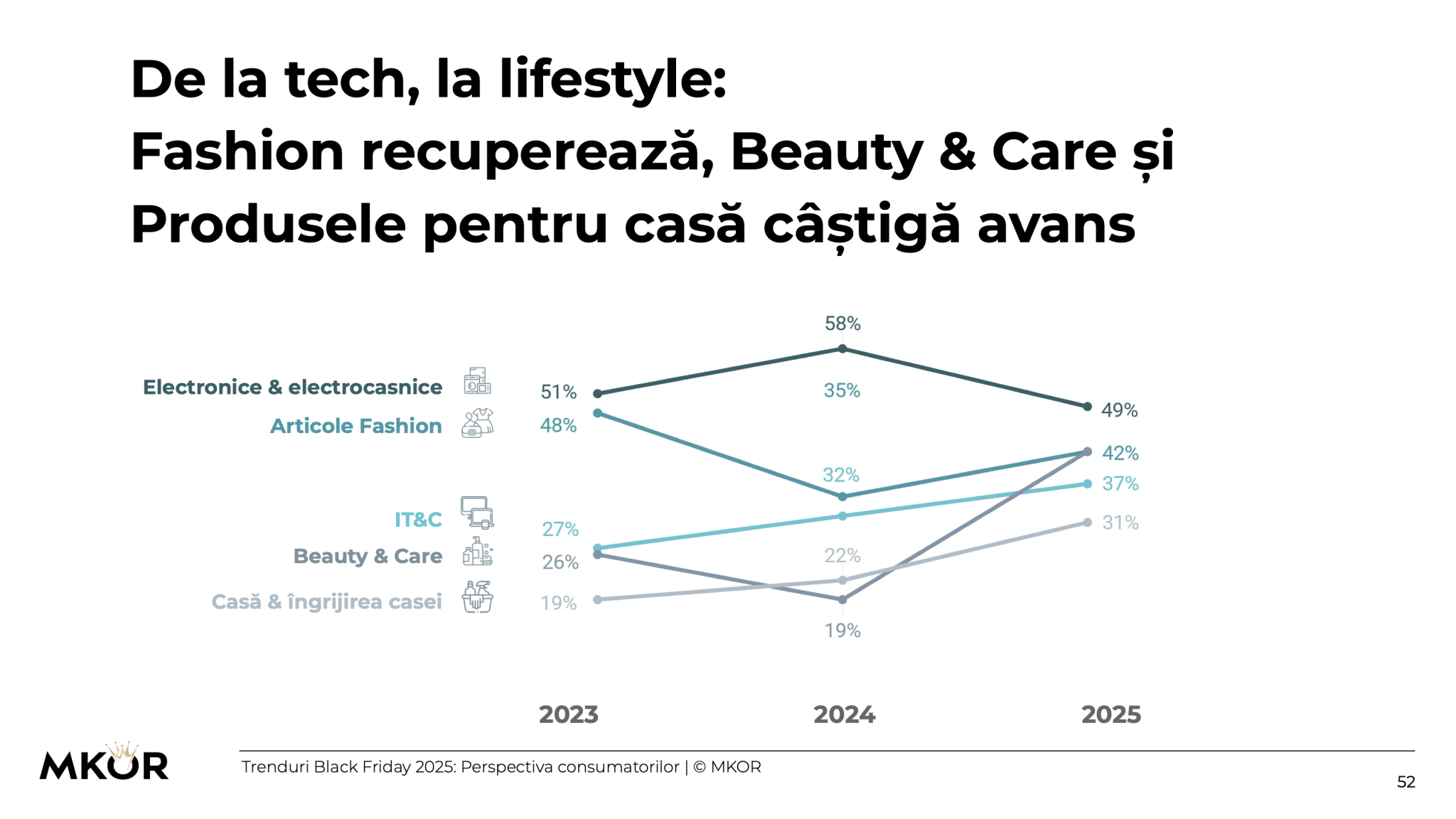

Myth #2 Debunked: Black Friday Isn’t Just About Electronics

The era when Black Friday was exclusively synonymous with discounts on TVs and laptops is over. In 2025, the shopping cart has dramatically diversified, reflecting a clear transition from occasional technical purchases to overall lifestyle optimization.

The clearest indicator of this change is the variety of the average cart: Romanians intend to buy products from 3.9 different categories, a significant increase compared to previous years. We are witnessing a rebalancing of priorities:

- From Tech to Lifestyle: Although Electronics and Home Appliances products remain at the top of lists (49%), they show a notable decrease from the 58% peak reached in 2024. At the same time, lifestyle categories are spectacularly recovering lost ground. Both Fashion items (42%) and Beauty & Care products (42%) have almost doubled their presence in purchasing intentions compared to the previous year, reaching parity.

- Home, the New Focus: Another clear winner is the category of home and home care products, which rises to 31% in preferences, signaling increased interest in home comfort.

- IT&C Remains Constant: IT&C products (phones, laptops, smartwatches) continue their steady growth, appearing on the list of 37% of buyers.

This diversification shows that Romanians no longer view Black Friday merely as a chance to replace an old appliance, but as a strategic opportunity to refresh their wardrobe, stock up on personal care products, and invest in home comfort, all under the umbrella of advantageous prices.

For retailers, the battlefield has extended far beyond electronics.

Budget Increases by 33%: From “What I Can Afford” to “What I Want and How I Get It”

Meticulous consumer planning is supported by a commensurate financial allocation. In 2025, the average declared budget for Black Friday reaches 2046 RON, a substantial increase of 33% compared to the previous year.

This increase, almost 500 RON more, reflects not only an adaptation to inflation but also a shift in mindset: from a passive approach based on “what I can afford” to a proactive one centered on “how I get what I want”.

The factors underlying budget setting confirm this evolution:

- Available financial resources remain an important pillar, but their influence drops from 67% in 2024 to 50% in 2025. Consumers are no longer strictly limited by the money in their accounts.

- The price of products on the list becomes an almost equally important factor (46%), indicating that the budget is now directly shaped by the cost of desired items.

- The current economic context weighs more in the decision, influencing 28% of buyers (a 10-percentage-point increase from 2024).

- The possibility of paying in installments or using other financial facilities (BNPL – Buy Now, Pay Later) has become a relevant criterion for 21% of Romanians, showing that they actively seek solutions to make wishlist purchases more accessible.

Discrepancies are also visible across segments. Millennials (2232 RON) and high-income individuals (2969 RON) allocate the most substantial budgets, while Generation Z (1512 RON), though enthusiastic, operates with smaller amounts but is more open to flexible financing solutions.

The Hybrid Revolution: Gen Z Shows That “Digital Natives” Doesn’t Mean “Digital Only”

Perhaps the most spectacular change in the Black Friday 2025 landscape is not what is being bought, but how. If in previous years online was the undisputed king, we are now witnessing an explosive rise of the hybrid (omnichannel) shopper, who desires a complete experience blending the advantages of both worlds.

Although exclusively online shopping remains the primary option for 47% of Romanians, this channel is on a clear downward trend, losing 13 percentage points compared to 2023. In contrast, the hybrid approach has exploded, growing from 26% in 2023 to 39% in 2025.

The engine of this transformation is, surprisingly for some, Generation Z. Contrary to the myth that digital natives live exclusively online, data reveals a nuanced reality: no less than 56% of young people aged 18 to 28 intend to combine online shopping with physical store purchases.

This percentage is 20 percentage points higher than the previous year, signaling a fundamental shift in behavior.

What does this mean?

Young people use digital for research and comparisons, but they seek in physical stores:

- Experience and Instant Gratification: The possibility of testing products (especially in fashion and beauty categories) and taking them home immediately, without waiting for delivery.

- Social Component: Turning shopping into a group activity with friends.

Therefore, to win the Gen Z customer, retailers must understand that “digital natives” doesn’t mean “digital only,” but rather “digital-first, but not digital-exclusive.” The in-store experience has become as important as the fluidity of the online platform.

Myth #3 Debunked: Are Discounts Not Real? Most Still Trust Them

This is perhaps the most persistent criticism leveled against the event: “artificially inflated prices, discounts that aren’t real”.

And, indeed, skepticism is the main reason why some Romanians choose not to participate: 30% of non-buyers cite distrust in the fairness of offers.

However, generalizing this distrust to the entire population is a mistake. Data from 2025 shows that, for the overwhelming majority, Black Friday remains a credible and relevant event.

The proof? The fact that 62% of Romanians firmly intend to buy, and another 28% are undecided, waiting only for the right impulse to join in.

And this impulse is clear and quantifiable: the discount value. For 53% of undecided consumers, a substantial discount is the factor that would transform hesitation into purchase.

How substantial? The study shows that the psychological threshold is an average discount of 54%. This is the figure that, in their perception, separates a mundane offer from a real Black Friday opportunity. This conditional trust does not come from naivety but is validated by previous experiences.

Over half of the participants in the 2024 edition (56%) declared themselves satisfied with their purchases, giving an average satisfaction score of 5.5 out of 7. Thus, the myth of fake discounts is debunked by the behavior of the majority.

Although skepticism exists and acts as a filter, trust in the event is high enough to mobilize millions of buyers, as long as retailers deliver what they promise: real value.

Conclusions & Key Insights for Retailers

The 2025 study redraws the Black Friday map, transforming it from an impulsive event into a strategic marathon. For retailers, adaptation is not optional but essential to meet the expectations of a more calculated, informed, and demanding consumer. Here are the main strategic directions emerging from the data:

Planning is the New Normal:

The battle for the shopping cart no longer takes place in November, but in October. With 93% of customers having a prepared list, the retailers’ objective becomes clear: ensure your products are on that list.

Early communication, teasing campaigns, and pre-Black Friday offers become essential tools to capture the attention of the strategic consumer.

The Cart is Diverse and Lifestyle-Oriented:

The exclusivity of the electronics category has disappeared. The spectacular rise of Fashion, Beauty & Care, and Home & Deco categories shows that Romanians use Black Friday to optimize their lifestyle.

This opens huge opportunities for cross-selling, cross-category bundle packages, and campaigns that address the customer’s complete needs, not just a single purchase.

The Hybrid Experience Has Become Essential, Especially for Gen Z

The explosive growth of the omnichannel channel shows that the line between online and offline has dissolved. Consumers, especially young ones, use online for research and offline for experience and instant gratification.

Retailers who offer a seamless experience, from online research to in-store try-ons or “click and collect” options, will win the loyalty of this valuable segment.

Perceived Value and Trust Convert the Undecided

The segment of 28% undecided consumers is too large to ignore. The key to attracting them is simple: offers that are perceived as real and valuable.

The 54% discount threshold is a clear indicator of expectations. In a market where skepticism still exists, transparency in price communication and offering substantial discounts can transform hesitation into conversion.

Information about Black Friday 2025 Research

The results are part of the MKOR study “Black Friday Consumer Trends 2025”. Data was collected in October 2025.

- Sample size: N=1000 respondents

- Target: general population of Romania aged between 18 and 55 years old

- Sample characteristics: nationally representative by gender, age, and geographical distribution

- Research method: opinion poll (CAWI)

- Instrument: online questionnaire

- Approach: online, through the MKOR Consumer Panel

Make Decisions Based on Data, Not Myths

The “Black Friday Consumer Trends 2025” study shows what 1000 Romanians want. But your audience has unique particularities.

Every decision you make in the coming period, from what products you discount and by how much, to the communication channels you invest in, can be based on intuition or on concrete data about your customers. MKOR helps you eliminate risk and act with precision.

Through agile market research, you can test messages, validate offers, and deeply understand what your customers truly want, directly from the source.

Contact us to discover how market data can transform your Black Friday campaign into a measurable success.

Have you read everything? Comment / join our newsletter / read our other research posts!

Impact and Innovation in Research at MKOR in 2024: A Retrospective

January 27, 2025

0 Comments29 Minutes

How to Boost Your Black Friday Sales with Agile Research: Quick, Data-Driven Decisions

November 2, 2024

0 Comments7 Minutes