The latest MKOR market study offers valuable insights into consumer perspectives on Black Friday. Key findings from the 2024 data reveal:

- Approximately 5.5 million Romanians plan to shop during Black Friday in November 2024.

- 7 out of 10 Romanians closely follow retailers’ Black Friday promotions.

- Consistent Black Friday shopping patterns: Romanians are organized, typically planning their purchases about a month in advance.

- 80% of Romanians set a specific budget for Black Friday purchases, mirroring trends from last year.

This dedicated market study for the biggest shopping event of the year is part of MKOR’s annual usage & attitudes tracker, running since 2022. This research is unique in Romania, offering critical insights into Romanian consumers’ plans and expectations for Black Friday.

The study reveals how consumer purchase intentions evolve and how shoppers prepare for Black Friday. It also highlights shifts in wish lists and buying preferences from year to year.

In 2024, this study also evaluates the experience from Black Friday 2023.

With annual insights based on representative samples of Romanian consumers, the MKOR study has become an essential strategic tool for retailers aiming to maximize the impact of their Black Friday campaigns. Here’s what you gain:

- Anticipate consumer trends and benchmark between intentions and actual consumer behavior

- Efficiently segment campaigns for targeted reach

- Optimize offer planning to meet demand effectively

- Enhance the shopping experience to boost satisfaction

- Benchmark against competitors to refine your strategy

Conținut

Data from 2024 signals a need to refresh the Black Friday format in Romania. While it remains one of the most anticipated shopping events, with 5.5 million potential buyers, it’s clear that the market is maturing.

Consumers are becoming more organized and selective, with realistic expectations about discounts. The doubling of “rejector” consumers in the last three years indicates that the classic format may no longer hold the same appeal.

For retailers, 2024 could be the year to rethink the Black Friday experience, focusing on genuine discounts and adapting offers to meet consumers’ evolving expectations.

Alex Cimpoca – Data Genie MKOR

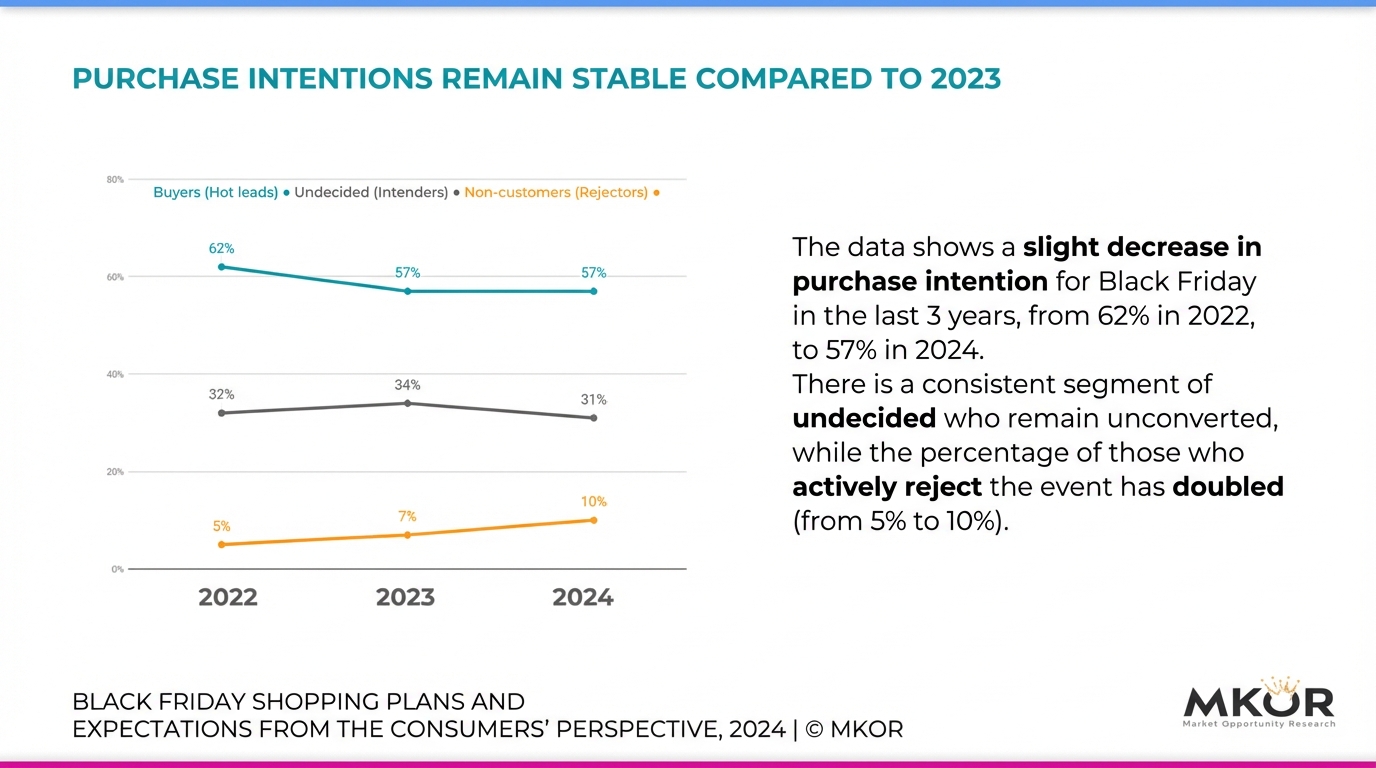

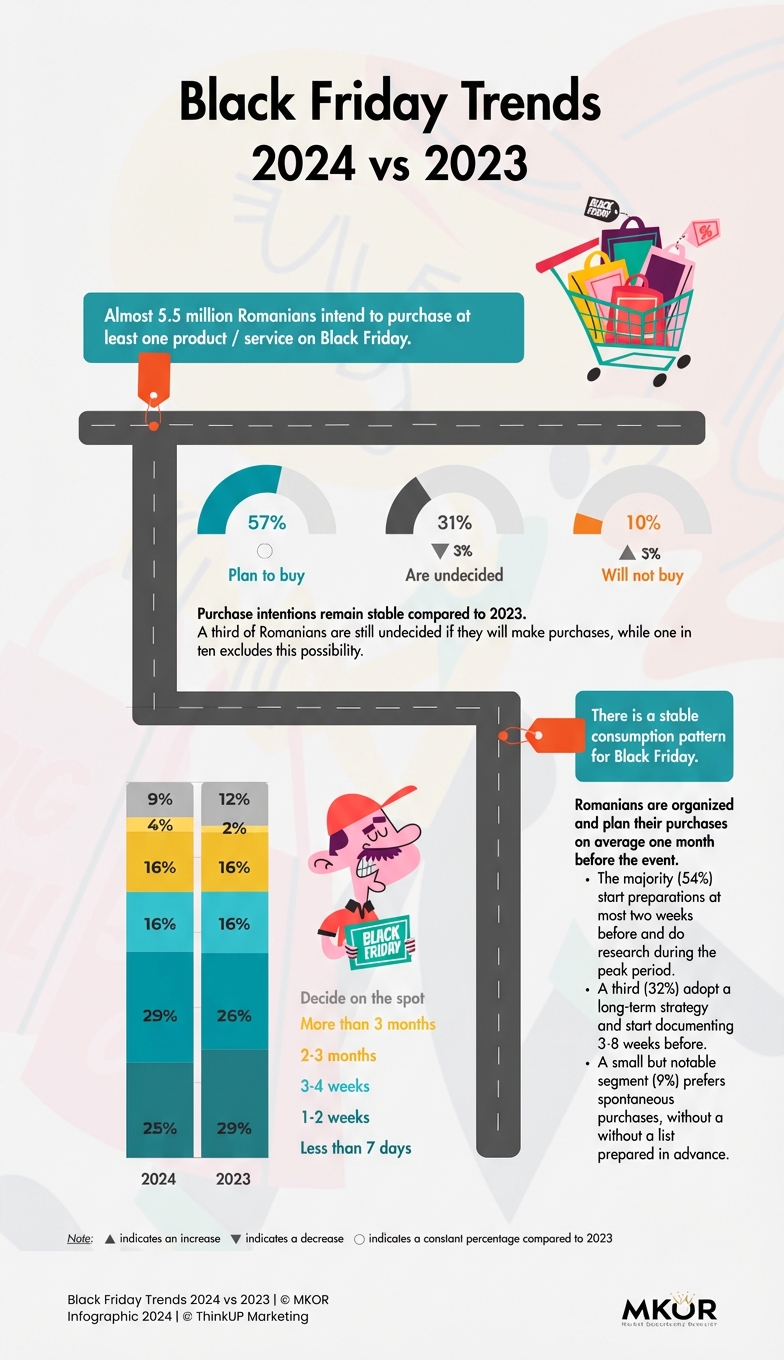

Evolution of Purchase Intentions: 2024 vs. 2023

According to MKOR’s analysis, 57% of Romanians aged 18 to 55 plan to shop on Black Friday—approximately 5.5 million people.

Another 3 million Romanians remain undecided, though they are likely to be swayed by substantial discounts, particularly prices slashed by 50% or more.

On the other hand, the percentage of “rejectors” has doubled in the past three years (from 5% in 2022 to 10% in 2024). The primary barrier? Persistent skepticism about the authenticity of discounts.

This increase in actively disengaged consumers, combined with a slight decline in undecided shoppers, signals the need for a strategic refresh to maintain Black Friday’s relevance.

There’s also a notable shift in discount expectations: compared to 2023, the percentage of shoppers seeking discounts over 50% has dropped by 9%.

Shopper Profiles: Actives, Undecideds, and Rejectors

Active Black Friday Shoppers include young people from Gen Z (ages 18-27) and Millennials (ages 28-43), as well as individuals with monthly incomes exceeding 6,000 RON.

Compared to 2023, the gender gap in purchase intentions has narrowed: from an 8-point lead in favor of women in 2023 to only a 3-point lead in 2024.

Those intending to shop view Black Friday primarily as an opportunity to acquire desired products, brands, or services at discounted prices (54%). Additionally, 23% plan to purchase Christmas gifts, and 14% plan for future birthday gifts.

Undecided Shoppers include both men and women, primarily from Gen X (ages 44-55) and individuals with incomes of at least 3,000 RON, although 8% have no income. The main purchasing barriers are financial (26% expect large discounts, ideally 50%) or practical (19% will only buy if they genuinely need something).

Men continue to be the primary Rejectors (68%), though this percentage is down from 2023 (an 8-point decrease). They choose not to participate in Black Friday, mostly due to skepticism about the discounts (34%) or because their budgets don’t allow for discretionary purchases (23%).

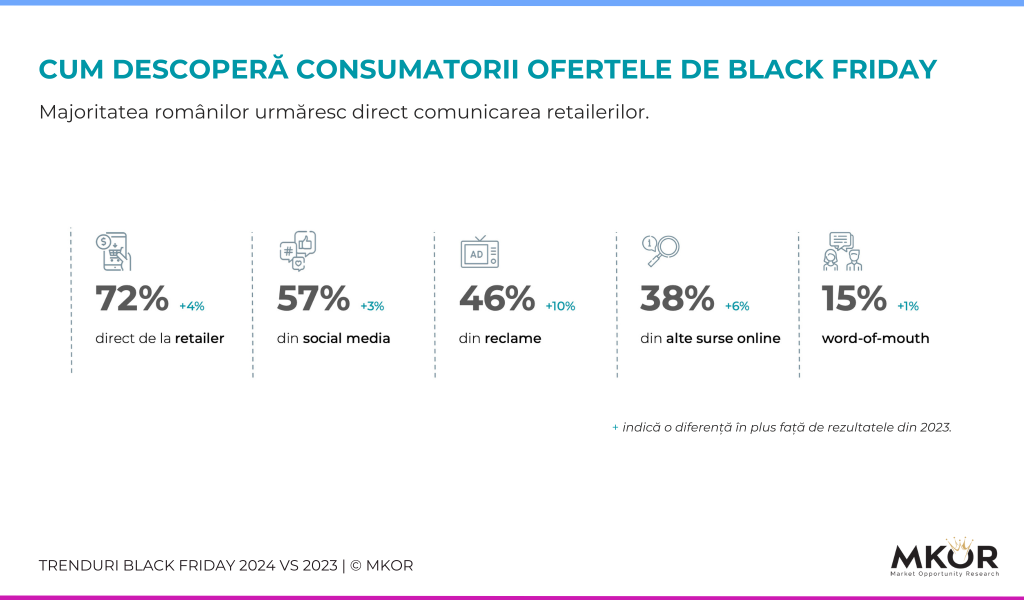

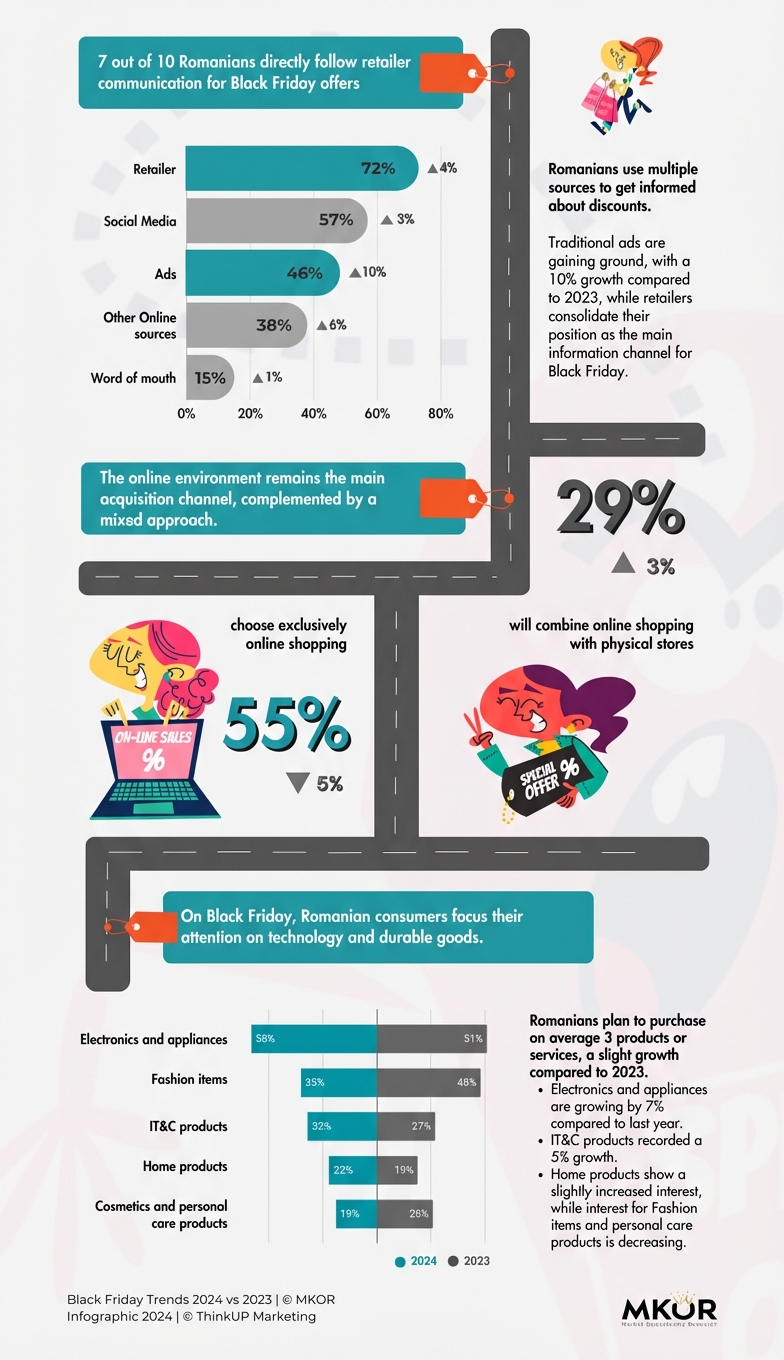

Sources of Information for Black Friday 2024 Deals

Romanians rely on multiple sources to stay informed about Black Friday discounts, using an average of three different sources.

The majority (72%) follow direct communication from retailers about Black Friday offers through various channels: apps, promotional emails, and online marketplaces.

However, individual analysis of sources shows that in 2024, Facebook remains the most-used source (49%). The social network surpasses retailer mobile apps, which have declined in popularity over the past three years (from 59% in 2022 to 44% in 2024).

At the same time, traditional advertising channels (TV, radio, outdoor) are gaining traction, with a 10% increase from 2023. These channels are particularly popular among undecided shoppers.

Shopping Behaviors: Consistent Black Friday Consumption Patterns

In general, Romanians show strong organizational skills, planning their Black Friday purchases about one month in advance.

However, most (54%) start preparations within two weeks of the event, focusing their research efforts during peak periods.

Generation Z, in particular, adopts this approach: 3 out of 10 Gen Z members create their shopping list no more than a week before Black Friday. This reflects a trend toward quick responsiveness to deals and a preference for a more flexible shopping experience.

On the other hand, Millennials and individuals with moderate incomes tend to be more organized, often beginning their purchase planning 2-3 months in advance.

A small but notable segment (9%) prefers spontaneous shopping, with no pre-prepared list.

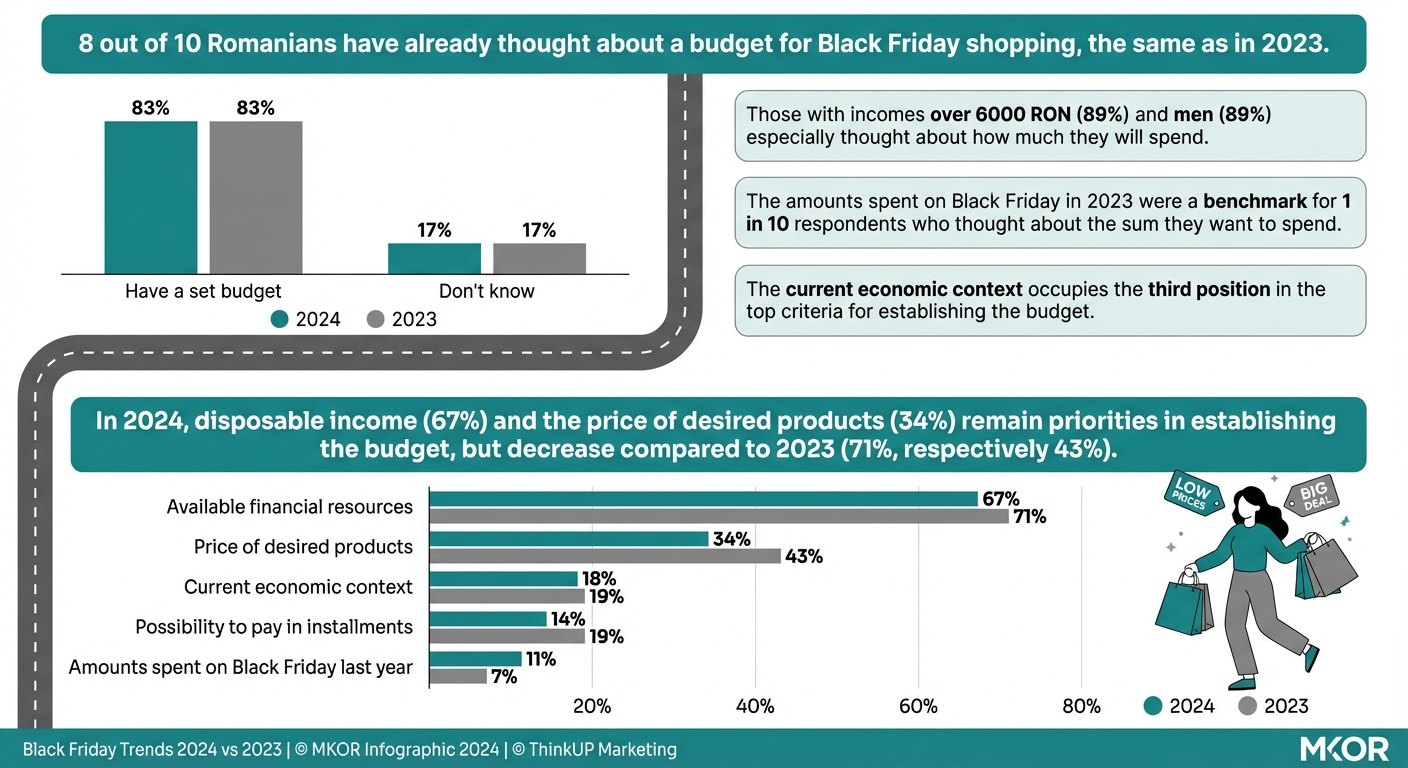

As in 2023, budgeting remains a key part of planning: 83% of those intending to shop have already set a specific amount they’re willing to spend for Black Friday purchases.

Online shopping remains the preferred method for Black Friday, despite a slight decline (5%) from 2023.

Individuals over 28, men, and those with moderate individual incomes primarily plan to shop online.

A notable portion of consumers adopts a mixed approach: 29% of respondents intend to combine online shopping with visits to physical stores. Generation Z, in particular, favors an omnichannel strategy (36%) due to the flexibility that various purchasing channels offer.

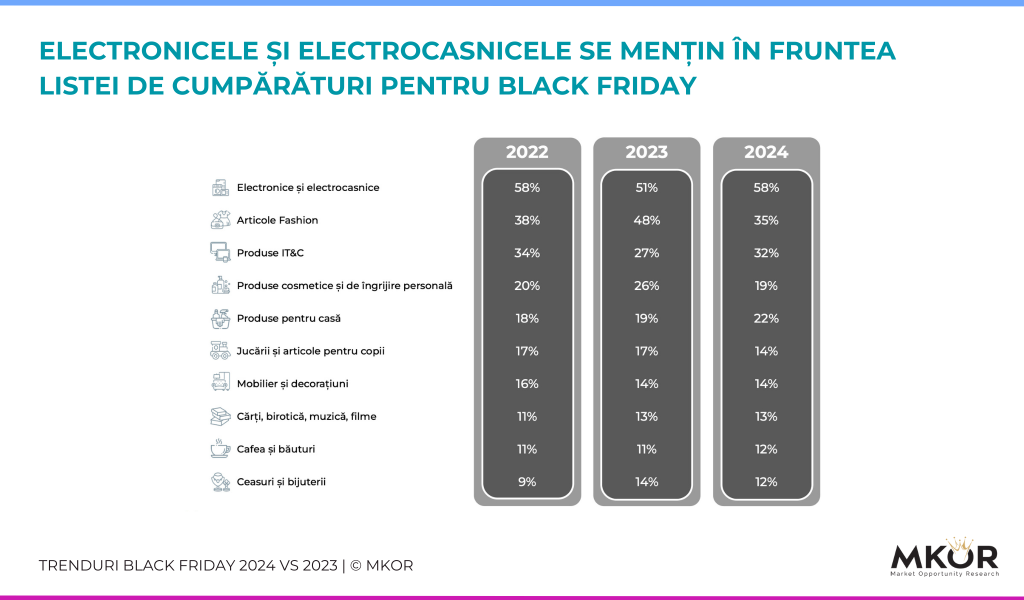

Consumer Preference Dynamics: Focus on Technology and Durable Goods

This Black Friday, Romanian consumers are focused on electronics and home appliances, fashion, and IT&C. They plan to purchase approximately three products/services, a slight increase compared to 2023.

Electronics and home appliances remain the consistent market leaders, with interest returning to the same level (58%) as in 2022. A similar trend is seen for IT&C products, a top priority for 32% of active shoppers (showing a 5% year-over-year increase).

In contrast, fashion items (clothing, footwear, accessories) show greater volatility. Although interest is close to 2022 levels, the overall trend is downward, with a 13% decrease from 2023. Interest in fashion remains steady among Gen Z (41%) and women (42%).

Evaluating the 2023 Shopping Experience and 2024 Expectations

7 out of 10 respondents made Black Friday purchases in 2023, but their satisfaction level with the experience was moderate, averaging 5.5 out of 7.

Among the negative aspects, half of the dissatisfied shoppers noted out-of-stock issues, especially men and Millennials who couldn’t find their desired products.

About a third of respondents mentioned minor technical issues on websites or apps, while 27% experienced long delivery times. Additionally, 20% felt the discounts were artificial, with prices inflated before the event.

For 2024, consumer expectations are clear: 6 in 10 Romanians expect substantial yet genuine discounts. Those most interested in discounts are Millennials, men, and individuals with moderate incomes, aiming to maximize their shopping budgets.

At the same time, product availability remains a priority for a quarter of respondents, especially for those with smaller budgets, who want assurance that they’ll find the products promoted in retailer campaigns.

About the Black Friday 2024 Shopping Study

The study was conducted by MKOR in October 2024 and is the only study in Romania that analyzes consumer plans and expectations for Black Friday from a consumer perspective.

- Sample size: 1,000 respondents, 95% confidence interval, margin of error +/-3.1%

- Characteristics: Random, stratified sample, nationally representative by gender, age (18-55 years), and geographic distribution, based on the latest data from the National Institute of Statistics

- Data collection: Online survey conducted using MKOR’s own panel

Who is MKOR?

MKOR is an innovative and agile research agency. We firmly believe that market-driven insights into consumer behavior and brand perception provide a clearer understanding of potential opportunities and challenges for your company. Agility and empathy in business are our superpowers.

Together, we can design a custom study tailored to the unique needs of your company. Our latest service, Agile Research, is specially developed for companies seeking market insights in a single week and on a highly accessible budget.

Agile Research is a flexible and rapid research service that empowers your company to gain valuable insights on consumers within a short timeframe and at low costs. Through Agile Research, you can ask 5-7 targeted questions and receive precise data from a nationally representative sample. This data will help you make informed decisions and build effective business strategies.

If you’d like to learn more about how Agile Research can help you, we recommend reading the article How to Boost Your Black Friday Sales (or Any Campaign) with Agile Research.

Black Friday Trends 2024 vs 2023 – In Images

Special thanks to Thinkup Marketing for bringing this research to life through visuals 👇

Have you read everything? Comment / join our newsletter / read our other research posts!

MKOR Consumer Sentiment Study: Principal Reasons for Romanian Concerns in 2023

April 16, 2024

0 Comments8 Minutes